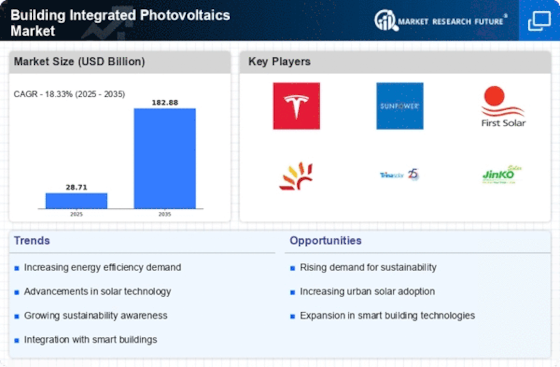

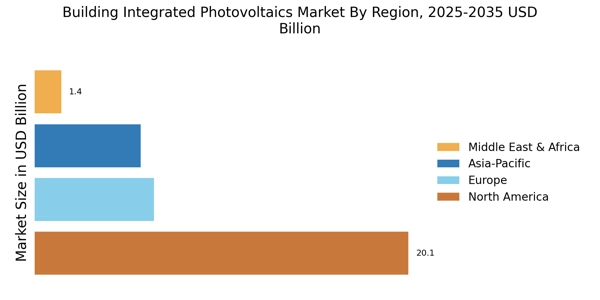

The Building Integrated Photovoltaics Market is currently experiencing a notable transformation, driven by the increasing emphasis on sustainable construction practices and energy efficiency. As urbanization accelerates, the integration of photovoltaic systems into building designs appears to be a strategic response to the growing demand for renewable energy sources. This market encompasses a diverse range of applications, including residential, commercial, and industrial sectors, where solar technologies are seamlessly incorporated into architectural elements. The trend towards energy independence and reduced carbon footprints is likely to propel further innovations in this field, as stakeholders seek to balance aesthetic appeal with functionality.

Moreover, advancements in materials and technology are enhancing the performance and affordability of building integrated photovoltaics. Modern solar module construction now prioritizes aesthetic versatility, allowing architects to seamlessly incorporate solar panels on building facades and windows without compromising the visual integrity of the design. The emergence of flexible solar panels and transparent photovoltaic materials suggests a shift towards more versatile applications, allowing for greater design freedom. As regulatory frameworks evolve to support renewable energy initiatives, the Building Integrated Photovoltaics Market is poised for substantial growth.

The versatility of building integrated photovoltaics allows for installation on vertical facades, skylights, and even balcony railings, maximizing the energy-harvesting potential of limited urban spaces.

This evolution may also foster collaborations between architects, engineers, and energy providers, creating a more integrated approach to energy generation within urban environments. The future landscape of this market could be characterized by a harmonious blend of technology and design, ultimately contributing to a more sustainable built environment.

Sustainable Urban Development

The Building Integrated Photovoltaics Market is increasingly aligned with the principles of sustainable urban development. As cities strive to reduce their environmental impact, integrating solar technologies into building designs becomes a viable solution. This trend reflects a broader commitment to creating energy-efficient structures that contribute positively to urban ecosystems.

The transition toward net-zero energy buildings is heavily supported by the advanced photovoltaics system, which now allows for power generation to be seamlessly embedded into the structure rather than functioning as an external attachment.

Technological Advancements

Recent innovations in photovoltaic materials and systems are reshaping the Building Integrated Photovoltaics Market. The introduction of lightweight, flexible solar panels and transparent technologies indicates a shift towards more adaptable solutions. These advancements not only enhance energy generation but also expand design possibilities for architects and builders.

The rapid evolution of solar photovoltaic (PV) technology is enabling a shift from traditional rooftop installations to sophisticated systems where solar panels for buildings serve as both energy generators and primary structural components.

Regulatory Support and Incentives

Government policies and incentives are playing a crucial role in the growth of the Building Integrated Photovoltaics Market. As regulations increasingly favor renewable energy adoption, stakeholders are encouraged to invest in integrated solar solutions. This supportive environment is likely to accelerate market expansion and foster collaboration among various industry players.