Regulatory Support

Regulatory support is a significant driver for the Building Integrated Photovoltaics Facade Market. Governments worldwide are implementing policies and incentives to promote renewable energy adoption, including tax credits, rebates, and grants for building-integrated solar technologies. These supportive measures encourage developers and builders to incorporate photovoltaic facades into their projects, thereby enhancing the market's growth potential. Additionally, building codes are increasingly mandating energy efficiency standards, which often include provisions for renewable energy integration. This regulatory landscape creates a favorable environment for the Building Integrated Photovoltaics Facade Market, as compliance with these standards can lead to reduced operational costs and improved building performance. Recent data suggests that regions with strong regulatory frameworks for renewable energy see higher rates of photovoltaic adoption, indicating a direct correlation between policy support and market growth.

Rising Energy Costs

Rising energy costs are driving the demand for the Building Integrated Photovoltaics Facade Market. As traditional energy prices continue to escalate, building owners and developers are seeking alternative energy solutions to mitigate operational expenses. The integration of photovoltaic facades offers a dual benefit: generating renewable energy while reducing reliance on grid electricity. This trend is particularly pronounced in regions where energy prices have surged, prompting a shift towards self-sustaining building designs. The Building Integrated Photovoltaics Facade Market stands to gain from this economic pressure, as more stakeholders recognize the long-term financial advantages of investing in solar technologies. Market analysis indicates that the cost of solar energy has decreased significantly over the past decade, making it an increasingly attractive option for new constructions and retrofitting existing buildings.

Sustainability Focus

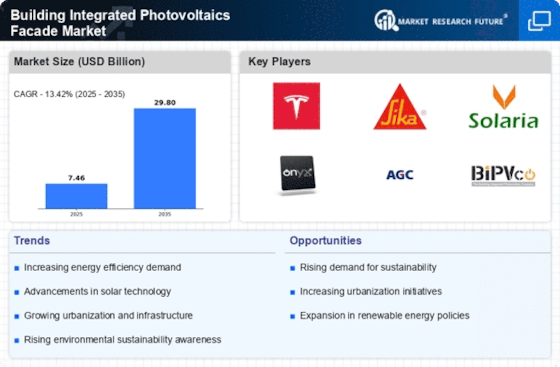

The increasing emphasis on sustainability is a primary driver for the Building Integrated Photovoltaics Facade Market. As urbanization accelerates, the demand for energy-efficient buildings rises. This trend is reflected in the growing number of green building certifications, which often require the integration of renewable energy sources. The Building Integrated Photovoltaics Facade Market is positioned to benefit from this shift, as these facades not only generate energy but also contribute to the aesthetic appeal of structures. Furthermore, the global push towards reducing carbon footprints aligns with the adoption of photovoltaic technologies in building designs. According to recent data, the market for sustainable building materials is projected to reach substantial figures, indicating a robust growth trajectory for the Building Integrated Photovoltaics Facade Market.

Technological Advancements

Technological advancements play a crucial role in propelling the Building Integrated Photovoltaics Facade Market forward. Innovations in photovoltaic materials, such as thin-film technologies and building-integrated solar cells, enhance the efficiency and aesthetic integration of solar panels into building designs. These advancements not only improve energy conversion rates but also reduce the overall cost of installation. The emergence of smart building technologies, which incorporate energy management systems, further complements the Building Integrated Photovoltaics Facade Market by optimizing energy usage. As a result, the market is witnessing a surge in demand for advanced photovoltaic solutions that seamlessly blend with architectural designs. Recent statistics indicate that the efficiency of solar panels has improved significantly, which is likely to attract more architects and builders to consider integrating photovoltaics into their projects.

Consumer Awareness and Demand

Consumer awareness and demand for renewable energy solutions are pivotal drivers for the Building Integrated Photovoltaics Facade Market. As public consciousness regarding climate change and environmental sustainability grows, more individuals and organizations are prioritizing energy-efficient building designs. This shift in consumer preferences is influencing architects and builders to incorporate photovoltaic technologies into their projects. The Building Integrated Photovoltaics Facade Market is likely to benefit from this trend, as consumers increasingly seek properties that align with their values of sustainability and energy efficiency. Recent surveys indicate that a significant percentage of homebuyers are willing to pay a premium for energy-efficient features, suggesting a strong market potential for building-integrated photovoltaics. This heightened demand is expected to drive innovation and competition within the industry, further propelling its growth.