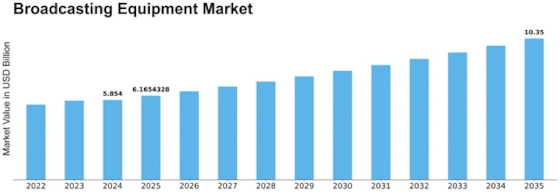

Broadcasting Equipment Size

Broadcasting Equipment Market Growth Projections and Opportunities

The broadcasting equipment market is a dynamic and ever-evolving industry, shaped by various market factors that influence its growth and development. One of the key drivers of this market is the rapid technological advancements in the field of broadcasting. As broadcasters strive to deliver high-quality content and enhance viewer experiences, they continually invest in state-of-the-art equipment. The transition from traditional broadcasting to digital platforms has fueled the demand for advanced broadcasting equipment, including cameras, transmitters, and editing systems.

Global economic conditions also play a crucial role in shaping the broadcasting equipment market. Economic growth, consumer spending, and corporate investments impact the overall demand for broadcasting services, consequently influencing the demand for broadcasting equipment. In times of economic prosperity, broadcasters are more likely to invest in upgrading their equipment and expanding their operations. Conversely, economic downturns may lead to budget constraints, prompting broadcasters to delay or scale back their equipment purchases.

Regulatory factors significantly impact the broadcasting equipment market as well. Government regulations and policies regarding broadcasting standards, licensing, and spectrum allocation directly influence the industry's landscape. Changes in regulations can either stimulate or impede market growth, affecting the procurement and utilization of broadcasting equipment. Broadcasters must navigate and comply with these regulations, shaping their investment decisions and equipment choices.

The competitive landscape is another critical factor shaping the broadcasting equipment market. The presence of established market players, technological innovation, and mergers and acquisitions contribute to the overall competitiveness. Intense competition often drives companies to introduce cutting-edge products and adopt cost-effective strategies to maintain or gain market share. Market consolidation, where larger companies acquire smaller ones, can also impact the availability and pricing of broadcasting equipment.

Consumer preferences and behavior are essential considerations for the broadcasting equipment market. The rise of on-demand and streaming services has altered how viewers consume content, leading broadcasters to adapt and invest in equipment that supports these evolving preferences. The demand for high-definition (HD) and ultra-high-definition (UHD) content, along with immersive technologies like virtual reality (VR) and augmented reality (AR), further influences equipment requirements.

Technological convergence is a noteworthy factor shaping the broadcasting equipment market. The integration of different technologies, such as artificial intelligence, cloud computing, and 5G connectivity, has a profound impact on the capabilities and functionalities of broadcasting equipment. These technological advancements enhance the efficiency and flexibility of broadcasting operations, providing broadcasters with new possibilities for content creation and delivery.

Environmental considerations have gained prominence in recent years, influencing the broadcasting equipment market. The industry is witnessing a shift towards sustainable and energy-efficient equipment. Broadcasters are increasingly adopting eco-friendly solutions to reduce their carbon footprint and adhere to environmental regulations. This shift towards green broadcasting equipment reflects a broader trend of corporate responsibility and sustainability in the industry.

Leave a Comment