Regulatory Compliance Pressures

In Brazil, regulatory compliance is a critical driver for the managed security-services market. The implementation of stringent data protection laws, such as the General Data Protection Law (LGPD), has heightened the need for organizations to ensure compliance with security standards. Companies face substantial fines for non-compliance, which can reach up to 2% of their revenue. This regulatory environment compels businesses to seek managed security services that can help them navigate complex compliance requirements. As organizations strive to avoid penalties and protect sensitive data, the demand for managed security services is expected to grow. This trend indicates a robust market opportunity for service providers who can offer tailored solutions to meet regulatory demands.

Increasing Cyber Threat Landscape

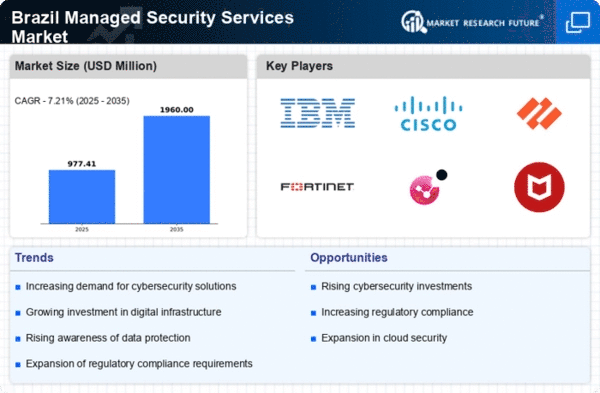

The managed security-services market in Brazil is experiencing heightened demand due to an escalating cyber threat landscape. With cyberattacks becoming more sophisticated, organizations are increasingly seeking robust security solutions. In 2025, it is estimated that cybercrime could cost the Brazilian economy over $20 billion annually. This alarming trend compels businesses to invest in managed security services to safeguard their assets and data. The growing awareness of potential threats, coupled with the need for compliance with regulations, drives organizations to adopt comprehensive security measures. As a result, the managed security-services market is likely to witness significant growth, as companies prioritize cybersecurity to protect their operations and maintain customer trust.

Shift Towards Cloud-Based Solutions

The managed security-services market in Brazil is witnessing a notable shift towards cloud-based security solutions. As organizations increasingly migrate their operations to the cloud, the need for specialized security services to protect cloud environments becomes paramount. In 2025, it is projected that cloud security spending in Brazil will exceed $1 billion, reflecting a growing recognition of the importance of securing cloud infrastructures. This trend is driven by the flexibility and scalability that cloud solutions offer, alongside the need for enhanced security measures. Consequently, managed security service providers are adapting their offerings to include cloud security solutions, thereby expanding their market presence and catering to the evolving needs of businesses.

Rising Awareness of Cybersecurity Risks

There is a growing awareness of cybersecurity risks among Brazilian businesses, which is significantly impacting the managed security-services market. As high-profile data breaches and cyber incidents make headlines, organizations are becoming more cognizant of the vulnerabilities they face. This heightened awareness is prompting companies to invest in managed security services to mitigate risks and enhance their security posture. In 2025, it is estimated that 70% of Brazilian companies will prioritize cybersecurity investments, reflecting a shift in mindset towards proactive security measures. This trend indicates a robust demand for managed security services, as organizations seek to protect their digital assets and maintain operational continuity.

Increased Investment in IT Infrastructure

The managed security-services market in Brazil is benefiting from increased investment in IT infrastructure. As businesses recognize the importance of robust IT systems, they are allocating more resources towards enhancing their technological capabilities. In 2025, IT spending in Brazil is projected to reach $50 billion, with a significant portion directed towards security solutions. This investment trend is driven by the need for organizations to modernize their IT environments and protect against evolving cyber threats. Consequently, managed security service providers are positioned to capitalize on this growth, offering tailored solutions that align with the increasing demand for secure and resilient IT infrastructures.