Support from Health Professionals

The herbal medicine market in Brazil is gaining support from health professionals who increasingly recognize the benefits of herbal remedies. Many practitioners are integrating herbal medicine into their treatment plans, often recommending specific products to patients. This endorsement from healthcare providers lends credibility to the herbal medicine market, encouraging more individuals to explore these options. Recent studies show that about 15% of healthcare professionals in Brazil advocate for herbal treatments, which may lead to a broader acceptance and utilization of herbal products among the population.

Increased Focus on Preventive Healthcare

The herbal medicine market in Brazil is expected to thrive because of an increasing focus on preventive healthcare. As healthcare costs rise and the population becomes more health-conscious, individuals are seeking ways to maintain wellness rather than solely treating illnesses. Herbal products are often perceived as preventive measures, contributing to overall health. Recent surveys indicate that nearly 25% of Brazilians are incorporating herbal supplements into their daily routines for preventive purposes. This proactive approach to health is expected to drive growth in the herbal medicine market, as consumers look for natural ways to enhance their well-being.

Rising Popularity of E-commerce Platforms

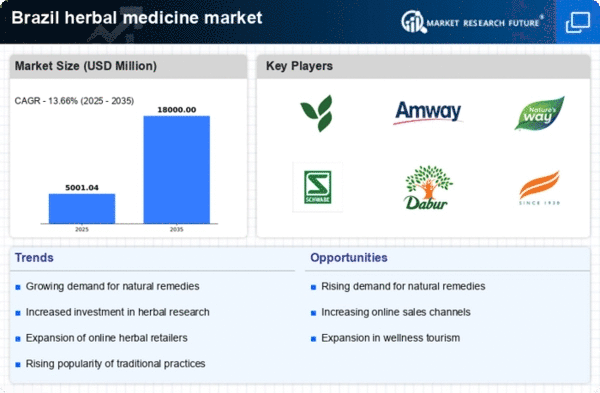

The herbal medicine market in Brazil is transforming due to the rise of e-commerce platforms. Online shopping has become increasingly popular, providing consumers with convenient access to a wide range of herbal products. This shift is particularly beneficial for niche herbal brands that may not have a strong presence in physical retail. Data suggests that online sales of herbal products have surged by approximately 20% in the past year, indicating a growing trend towards digital purchasing. This accessibility is likely to expand the consumer base and enhance the overall growth of the herbal medicine market.

Cultural Heritage and Traditional Practices

Brazil's rich cultural heritage plays a significant role in the herbal medicine market. Traditional practices, often passed down through generations, emphasize the use of local plants and herbs for medicinal purposes. This cultural inclination towards herbal remedies is not only a reflection of historical practices but also a response to modern health challenges. The herbal medicine market benefits from this deep-rooted connection, as many Brazilians continue to trust and utilize traditional knowledge. It is estimated that around 40% of the population engages with herbal medicine, indicating a strong cultural endorsement that supports market growth.

Growing Demand for Alternative Health Solutions

The herbal medicine market in Brazil is experiencing a notable increase in demand as consumers seek alternative health solutions. This trend is driven by a growing awareness of the potential side effects associated with conventional pharmaceuticals. Many individuals are turning to herbal remedies for their perceived safety and efficacy. According to recent data, approximately 30% of the Brazilian population has reported using herbal products as part of their health regimen. This shift towards natural alternatives is likely to bolster the herbal medicine market, as consumers prioritize holistic approaches to health and wellness.