Growing Consumer Awareness

In Brazil, there is an increasing consumer awareness regarding the benefits of fermentation ingredients. This trend is driven by a shift towards healthier eating habits and a preference for natural products. As consumers become more informed about the nutritional advantages of fermented foods, the demand for fermentation ingredients market is likely to rise. Reports indicate that the market for fermented products in Brazil has seen a growth rate of approximately 8% annually. This heightened awareness is pushing manufacturers to innovate and offer a wider range of fermentation ingredients, catering to the evolving preferences of health-conscious consumers.

Rising Popularity of Plant-Based Diets

The trend towards plant-based diets is gaining momentum in Brazil, influencing the fermentation ingredients market significantly. As more consumers adopt vegetarian and vegan lifestyles, the demand for plant-based fermentation ingredients is likely to increase. This shift is supported by a growing body of research highlighting the health benefits of plant-based diets, including improved digestion and enhanced nutrient absorption. The fermentation ingredients market is expected to adapt to this trend by offering innovative plant-based solutions, potentially capturing a larger share of the market as consumer preferences evolve.

Expansion of the Food and Beverage Sector

The food and beverage sector in Brazil is experiencing robust growth, which is positively impacting the fermentation ingredients market. With the rise of new food trends and the increasing popularity of artisanal and craft products, there is a growing need for diverse fermentation ingredients. The Brazilian food and beverage industry is projected to reach a value of $200 billion by 2026, creating substantial opportunities for fermentation ingredient suppliers. This expansion is likely to drive innovation and investment in fermentation technologies, further enhancing the market's potential.

Regulatory Support for Fermented Products

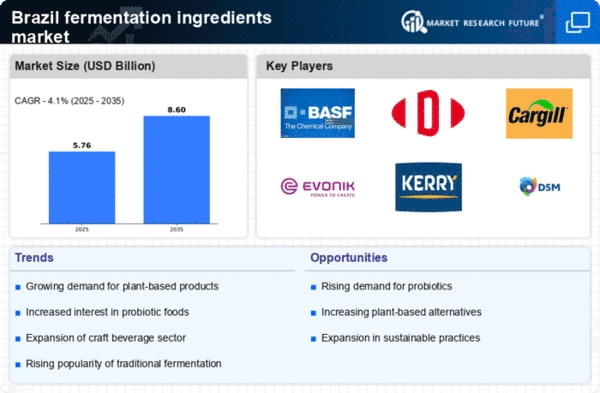

Brazilian regulatory bodies are increasingly supporting the production and consumption of fermented products. This support is evident in the establishment of guidelines that promote the use of fermentation ingredients in food production. Such regulations not only ensure safety and quality but also encourage manufacturers to explore new fermentation processes. the fermentation ingredients market will benefit from this regulatory environment, as it fosters innovation and enhances consumer trust in fermented products. As a result, the market is expected to grow steadily, with an estimated CAGR of 6% over the next five years.

Technological Innovations in Fermentation Processes

Technological advancements in fermentation processes are transforming the fermentation ingredients market in Brazil. Innovations such as precision fermentation and bioprocessing are enabling manufacturers to produce high-quality fermentation ingredients more efficiently. These technologies not only enhance product consistency but also reduce production costs, making fermentation ingredients more accessible to a broader range of consumers. As the market continues to evolve, it is anticipated that these technological innovations will play a crucial role in driving growth, with the potential to increase market size by 10% over the next few years.