Expansion of Export Markets

Brazil's feed premix market is poised for growth due to the expansion of export markets for animal products. With increasing global demand for meat and dairy, Brazilian producers are looking to enhance their competitiveness through high-quality feed premixes. In 2025, it is projected that exports of Brazilian meat could reach $8 billion, necessitating the use of superior feed formulations to ensure product quality. This trend is encouraging the feed premix market to innovate and develop products that meet international standards, thereby positioning Brazil as a key player in The feed premix market.

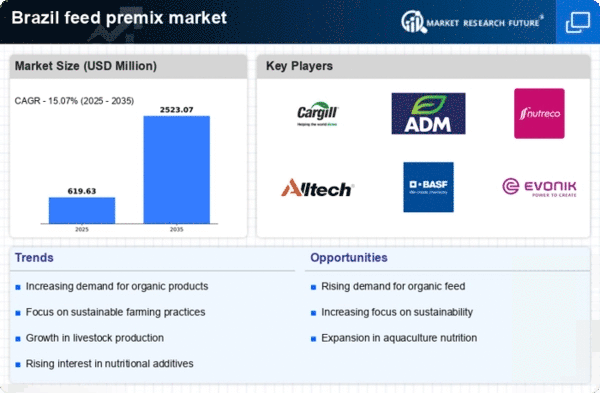

Increasing Livestock Production

The feed premix market in Brazil is experiencing growth due to the rising demand for livestock products. As the population increases, so does the need for meat, dairy, and eggs. In 2025, Brazil's livestock sector is projected to expand by approximately 3.5%, leading to a higher requirement for feed premixes that enhance animal health and productivity. This growth is driven by both domestic consumption and export opportunities, particularly in markets such as Asia and Europe. The feed premix market is adapting to these demands by developing specialized formulations that cater to the nutritional needs of various livestock species, thereby ensuring optimal growth rates and feed efficiency.

Rising Awareness of Animal Welfare

There is a growing awareness of animal welfare among Brazilian consumers, which is influencing the feed premix market. As consumers become more conscious of the conditions in which livestock are raised, there is an increasing demand for feed premixes that support humane and ethical farming practices. In 2025, it is anticipated that approximately 40% of consumers will prioritize animal welfare in their purchasing decisions. This shift is prompting feed premix market players to develop products that not only enhance animal health but also align with ethical standards, thereby appealing to a more socially responsible consumer base.

Regulatory Support for Animal Nutrition

Brazil's government has implemented various regulations aimed at improving animal health and nutrition, which positively impacts the feed premix market. These regulations encourage the use of scientifically formulated feed premixes that meet specific nutritional standards. In 2025, the Brazilian Ministry of Agriculture is expected to introduce new guidelines that promote the use of additives and supplements in animal feed, enhancing the overall quality of livestock products. This regulatory support is likely to drive innovation within the feed premix market, as manufacturers seek to comply with these standards while also addressing consumer preferences for healthier and more sustainable food options.

Technological Innovations in Feed Production

The feed premix market in Brazil is benefiting from technological advancements in feed production processes. Innovations such as precision nutrition and automated mixing systems are enhancing the efficiency and accuracy of feed premix formulations. In 2025, it is estimated that the adoption of these technologies could increase production efficiency by up to 25%. This trend is likely to lead to cost savings for producers and improved product quality, thereby strengthening the competitive position of the feed premix market. As technology continues to evolve, it may also facilitate the development of customized feed solutions tailored to specific livestock needs.