Advancements in Research and Development

Ongoing advancements in research and development are propelling the Blood Thinning Drugs Market forward. Pharmaceutical companies are investing heavily in R&D to discover new anticoagulants that offer improved efficacy and safety profiles. Recent studies indicate that novel anticoagulants, such as direct oral anticoagulants, are gaining traction due to their ease of use and reduced monitoring requirements. This shift towards innovative therapies is likely to attract more patients and healthcare providers, thereby expanding the market. Additionally, the exploration of combination therapies and personalized medicine approaches is expected to enhance treatment outcomes, further driving market growth. As a result, the Blood Thinning Drugs Market is witnessing a dynamic evolution, with new products entering the market that cater to diverse patient needs.

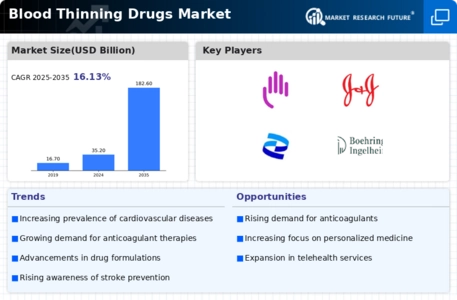

Increasing Incidence of Cardiovascular Diseases

The rising prevalence of cardiovascular diseases is a primary driver of the Blood Thinning Drugs Market. As conditions such as atrial fibrillation and deep vein thrombosis become more common, the demand for anticoagulants is expected to surge. According to recent statistics, cardiovascular diseases account for a significant portion of global mortality, prompting healthcare systems to prioritize prevention and treatment. This trend is likely to bolster the market for blood thinners, as they play a crucial role in managing these conditions. Furthermore, the aging population, which is more susceptible to cardiovascular issues, contributes to the growing need for effective blood-thinning therapies. Consequently, pharmaceutical companies are focusing on developing innovative anticoagulants to meet this increasing demand, thereby enhancing their market presence in the Blood Thinning Drugs Market.

Regulatory Support and Approval for New Anticoagulants

Regulatory support and expedited approval processes for new anticoagulants are driving growth in the Blood Thinning Drugs Market. Regulatory agencies are increasingly recognizing the need for innovative therapies to address unmet medical needs in anticoagulation. Recent approvals of novel anticoagulants have expanded treatment options for patients, leading to increased market competition. This regulatory environment encourages pharmaceutical companies to invest in the development of new blood thinners, as they can bring their products to market more swiftly. Consequently, the availability of a broader range of anticoagulants is likely to enhance patient choice and improve treatment outcomes, further stimulating the Blood Thinning Drugs Market.

Rising Geriatric Population and Associated Health Risks

The rising geriatric population is a critical driver of the Blood Thinning Drugs Market. As individuals age, they are more prone to various health conditions, including cardiovascular diseases and thromboembolic disorders. This demographic shift is expected to lead to an increased demand for anticoagulant therapies, as older adults often require long-term management of their health conditions. Recent demographic data suggests that the proportion of individuals aged 65 and older is steadily increasing, which correlates with a higher incidence of conditions necessitating blood thinners. Consequently, pharmaceutical companies are likely to focus on developing formulations that cater specifically to the needs of the elderly, thereby enhancing their market share in the Blood Thinning Drugs Market.

Growing Awareness and Education on Anticoagulation Therapy

The increasing awareness and education surrounding anticoagulation therapy are significant factors influencing the Blood Thinning Drugs Market. Healthcare professionals and patients are becoming more informed about the risks associated with thromboembolic events and the benefits of anticoagulant therapy. Educational initiatives and campaigns aimed at promoting understanding of blood-thinning medications are likely to enhance patient compliance and adherence to prescribed treatments. This heightened awareness is expected to lead to an uptick in prescriptions for blood thinners, as patients seek to manage their health proactively. Furthermore, as healthcare systems emphasize preventive care, the demand for anticoagulants is anticipated to rise, thereby positively impacting the Blood Thinning Drugs Market.