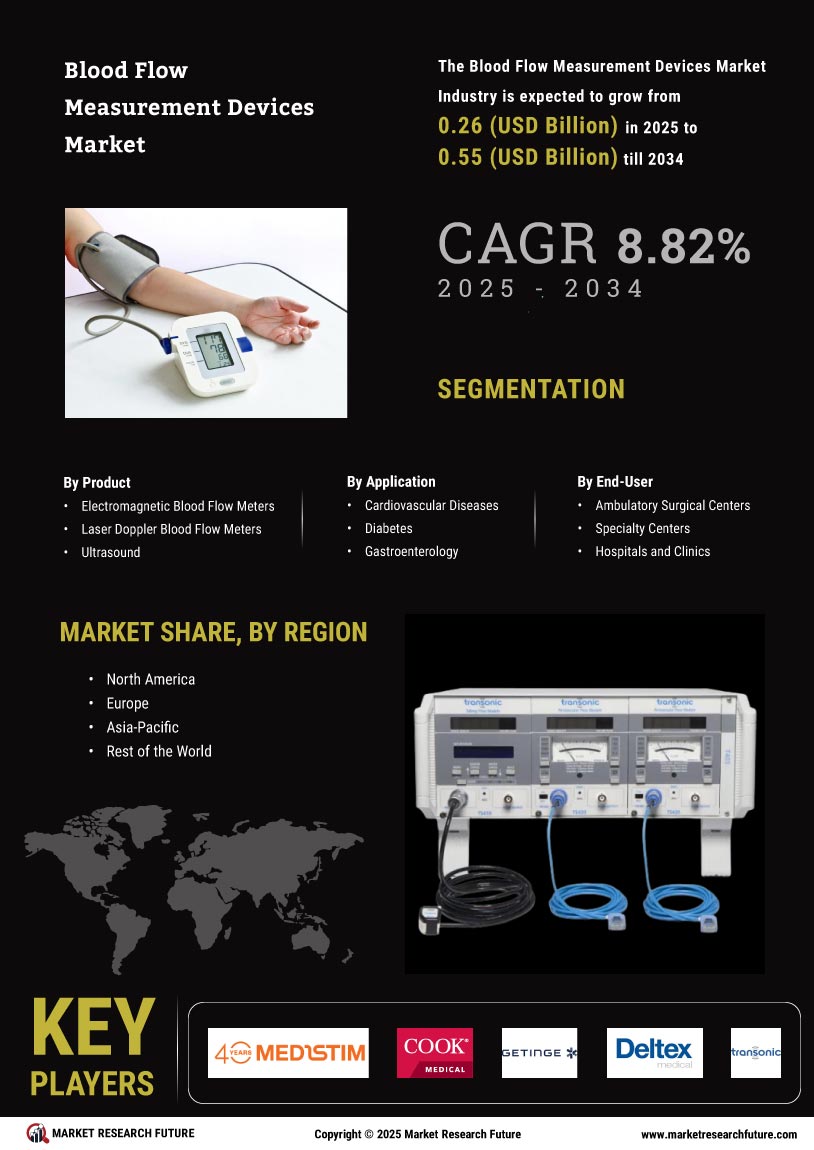

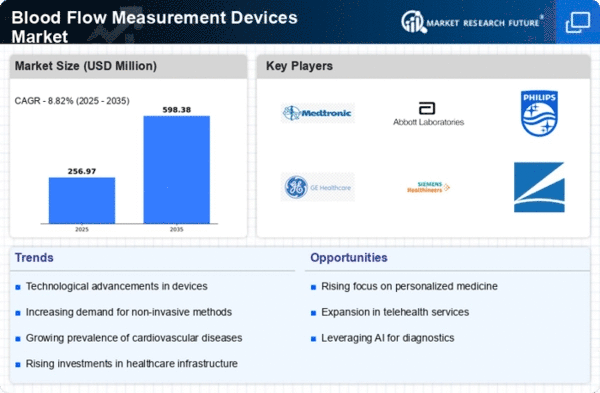

Market Growth Projections

The Global Blood Flow Measurement Devices Market Industry is projected to experience substantial growth over the next decade. With an estimated market value of 0.24 USD Billion in 2024, the industry is expected to expand significantly, potentially reaching 0.6 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate of 8.66% from 2025 to 2035, driven by factors such as technological advancements, increasing healthcare expenditure, and a growing geriatric population. These projections highlight the dynamic nature of the market and the opportunities for innovation and investment in blood flow measurement technologies.

Technological Advancements

The Global Blood Flow Measurement Devices Market Industry is experiencing rapid technological advancements, which are enhancing the accuracy and efficiency of blood flow measurement. Innovations such as non-invasive techniques and portable devices are becoming increasingly prevalent. For instance, the introduction of advanced Doppler ultrasound technology has improved diagnostic capabilities. These advancements not only facilitate better patient outcomes but also drive market growth. As the industry evolves, the demand for sophisticated devices is expected to rise, contributing to the market's projected value of 0.24 USD Billion in 2024 and a potential increase to 0.6 USD Billion by 2035.

Growing Geriatric Population

The Global Blood Flow Measurement Devices Market Industry is also driven by the growing geriatric population, which is more susceptible to cardiovascular diseases and other health complications. As the global population ages, the need for effective monitoring and management of blood flow becomes increasingly critical. Older adults often require regular assessments to prevent severe health issues, thereby increasing the demand for blood flow measurement devices. This demographic shift is expected to significantly influence market dynamics, contributing to the anticipated growth rate of 8.66% CAGR from 2025 to 2035, as healthcare providers seek to address the unique needs of this population.

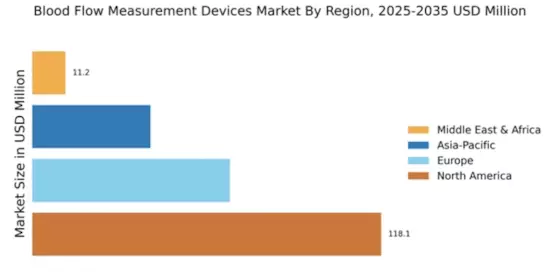

Increased Healthcare Expenditure

The Global Blood Flow Measurement Devices Market Industry is benefitting from increased healthcare expenditure across various regions. Governments and private sectors are investing more in healthcare infrastructure, leading to enhanced access to advanced medical technologies. This trend is particularly evident in developing nations, where healthcare budgets are expanding to accommodate modern diagnostic tools. As a result, the demand for blood flow measurement devices is likely to surge, supporting the market's growth trajectory. The projected market value of 0.24 USD Billion in 2024 is indicative of this trend, with expectations of reaching 0.6 USD Billion by 2035 as healthcare investments continue to rise.

Regulatory Support and Standards

The Global Blood Flow Measurement Devices Market Industry is positively impacted by regulatory support and the establishment of standards for medical devices. Governments and health organizations are implementing guidelines that promote the development and use of advanced blood flow measurement technologies. This regulatory framework not only ensures the safety and efficacy of devices but also encourages innovation within the industry. As manufacturers align their products with these standards, the market is likely to witness increased adoption rates. The anticipated growth to 0.6 USD Billion by 2035 reflects the potential for regulatory support to enhance market stability and foster advancements in blood flow measurement.

Rising Prevalence of Cardiovascular Diseases

The Global Blood Flow Measurement Devices Market Industry is significantly influenced by the rising prevalence of cardiovascular diseases worldwide. With heart-related ailments becoming more common, the demand for effective diagnostic tools is escalating. According to health statistics, cardiovascular diseases account for a substantial portion of global mortality rates. This trend necessitates the use of blood flow measurement devices to monitor and manage these conditions effectively. Consequently, the market is poised for growth, with an anticipated compound annual growth rate of 8.66% from 2025 to 2035, reflecting the urgent need for innovative solutions in cardiovascular health.