Growing Focus on Personalized Medicine

The shift towards personalized medicine is driving the blood flow-measurement-devices market. As healthcare moves away from a one-size-fits-all approach, there is a growing emphasis on tailored treatment plans based on individual patient needs. Blood flow-measurement devices play a crucial role in this paradigm by providing essential data that informs personalized treatment strategies. This trend is particularly evident in the management of chronic conditions, where precise monitoring of blood flow can lead to more effective interventions. The blood flow-measurement-devices market is likely to benefit from this trend, with an anticipated increase in demand for devices that support personalized healthcare solutions.

Rising Awareness of Preventive Healthcare

The growing awareness of preventive healthcare is influencing the blood flow-measurement-devices market. As individuals become more proactive about their health, there is an increasing demand for tools that facilitate early detection of potential health issues. Blood flow-measurement devices are integral to this preventive approach, allowing for regular monitoring of cardiovascular health. Educational campaigns and public health initiatives are further promoting the importance of regular health check-ups, which is likely to drive the adoption of these devices. Consequently, The blood flow-measurement-devices market is expected to see a surge in demand, with estimates suggesting growth of approximately 6% over the next few years.

Rising Incidence of Cardiovascular Diseases

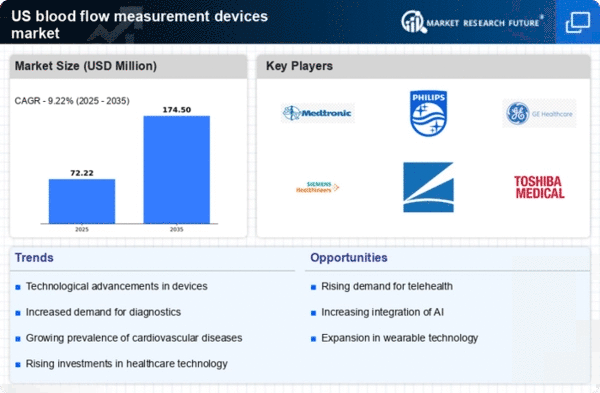

The increasing prevalence of cardiovascular diseases in the US is a primary driver for the blood flow-measurement-devices market. According to recent statistics, cardiovascular diseases account for approximately 697,000 deaths annually, representing about 1 in every 5 deaths. This alarming trend necessitates the adoption of advanced diagnostic tools, including blood flow-measurement devices, to monitor and manage these conditions effectively. Healthcare providers are increasingly recognizing the importance of early detection and continuous monitoring, which is likely to boost demand for these devices. As a result, the blood flow-measurement-devices market is expected to experience substantial growth, with projections indicating a compound annual growth rate (CAGR) of around 8% over the next five years.

Technological Innovations in Medical Devices

Technological advancements in medical devices are significantly influencing the blood flow-measurement-devices market. Innovations such as non-invasive measurement techniques and portable devices are enhancing the accuracy and convenience of blood flow assessments. For instance, devices that utilize advanced imaging techniques or wearable technology are becoming increasingly popular among healthcare professionals. These innovations not only improve patient outcomes but also facilitate remote monitoring, which is particularly relevant in today's healthcare landscape. The blood flow-measurement-devices market is projected to grow as these technologies become more integrated into clinical practice, with an estimated market value reaching $1.5 billion by 2027.

Increased Investment in Healthcare Infrastructure

Investment in healthcare infrastructure in the US is a significant driver for the blood flow-measurement-devices market. As hospitals and clinics expand their facilities and upgrade their equipment, there is a corresponding increase in the demand for advanced diagnostic tools. Government initiatives aimed at improving healthcare access and quality are also contributing to this trend. For example, funding programs that support the acquisition of state-of-the-art medical devices are likely to enhance the availability of blood flow-measurement devices in various healthcare settings. This influx of investment is expected to propel the blood flow-measurement-devices market forward, with growth rates projected to exceed 7% annually.