Advancements in Edge Computing

Advancements in edge computing are significantly impacting the Blockchain IoT Market. By processing data closer to the source, edge computing reduces latency and enhances the efficiency of IoT applications. When combined with blockchain technology, this approach ensures secure and real-time data transactions. The integration of edge computing with blockchain can potentially improve the performance of IoT networks, making them more resilient to cyber threats. As industries increasingly adopt edge computing solutions, the demand for blockchain integration is likely to rise, thereby fostering growth in the Blockchain IoT Market.

Regulatory Compliance and Standards

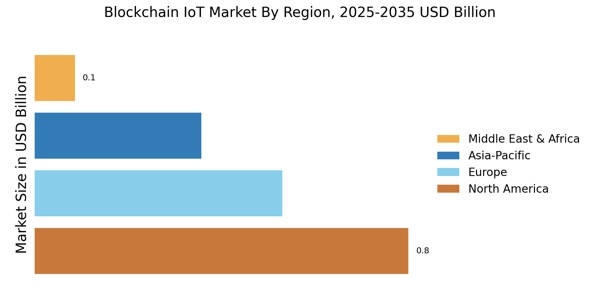

Regulatory compliance is increasingly influencing the Blockchain IoT Market. Governments and regulatory bodies are establishing frameworks to ensure data privacy and security in IoT applications. Blockchain technology, with its inherent transparency and traceability, aligns well with these regulatory requirements. Organizations are compelled to adopt blockchain solutions to meet compliance standards, thereby driving market growth. For instance, the implementation of GDPR in Europe has prompted businesses to seek blockchain-based solutions for data management. This trend indicates a growing recognition of blockchain's potential to facilitate compliance, further enhancing the Blockchain IoT Market.

Rise of Smart Cities and Infrastructure

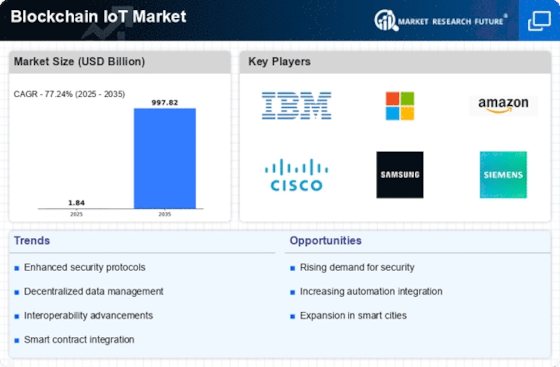

The emergence of smart cities is a pivotal driver for the Blockchain IoT Market. As urban areas evolve, the integration of IoT devices in public infrastructure becomes essential for efficient resource management. Blockchain technology facilitates secure data sharing among various stakeholders, including government agencies and private entities. This interconnectedness enhances operational efficiency and transparency. Reports indicate that investments in smart city projects are expected to reach trillions of dollars in the coming years, further stimulating the demand for blockchain solutions in IoT applications. Consequently, the Blockchain IoT Market is poised for substantial growth.

Increased Demand for Secure Transactions

The Blockchain IoT Market experiences a surge in demand for secure transactions, driven by the need for enhanced data integrity and security. As organizations increasingly adopt IoT devices, the potential for data breaches and cyber threats escalates. Blockchain technology offers a decentralized and immutable ledger, which significantly mitigates these risks. According to recent estimates, the integration of blockchain in IoT applications could reduce fraud by up to 50%. This heightened focus on security is compelling businesses to invest in blockchain solutions, thereby propelling the growth of the Blockchain IoT Market.

Growing Adoption of Decentralized Applications

The growing adoption of decentralized applications (dApps) is a notable driver for the Blockchain IoT Market. dApps leverage blockchain technology to provide enhanced security, transparency, and user control over data. As businesses recognize the benefits of decentralization, the demand for dApps in IoT applications is expected to increase. This trend is particularly evident in sectors such as supply chain management and healthcare, where data integrity is paramount. The proliferation of dApps could lead to a substantial increase in blockchain investments, thereby propelling the Blockchain IoT Market forward.