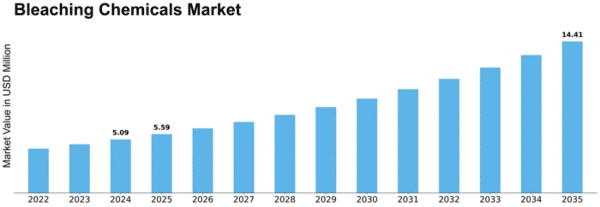

Bleaching Chemicals Size

Bleaching Chemicals Market Growth Projections and Opportunities

The Bleaching Chemicals Market is influenced by a multitude of factors that collectively shape its dynamics, growth trends, and overall competitiveness. These factors encompass both industry-specific considerations and broader economic and environmental influences. Here's a succinct breakdown of key market factors defining the landscape of the Bleaching Chemicals Market:

Pulp and Paper Industry Dominance:

Bleaching chemicals, particularly chlorine-based and hydrogen peroxide, are integral to the pulp and paper industry for the bleaching of wood pulp.

The demand for bleaching agents in paper production, driven by the growing paper and packaging industries, significantly influences the market.

Textile and Laundry Applications:

Bleaching chemicals are widely used in the textile industry for the treatment of fabrics to achieve desired colors and remove impurities.

The laundry and textile care sector's reliance on effective bleaching solutions contributes to the demand for bleaching chemicals.

Water Treatment and Disinfection:

Chlorine-based bleaching agents, such as sodium hypochlorite, play a crucial role in water treatment and disinfection processes.

The need for clean and safe drinking water, wastewater treatment, and public sanitation drives the demand for bleaching chemicals in the water treatment sector.

Growing Demand for White and Bright Textiles:

Consumer preferences for white and bright textiles in apparel, home textiles, and other applications fuel the demand for effective and sustainable bleaching solutions.

The textile and fashion industry's emphasis on aesthetics and quality influences the choice of bleaching chemicals.

Paper Recycling Industry Usage:

Bleaching chemicals play a role in the paper recycling process, where they help remove inks and colorants from recovered paper.

The increasing emphasis on sustainability and recycling practices contributes to the demand for bleaching agents in the paper recycling industry.

Shift towards Environmentally Friendly Options:

Growing environmental awareness prompts the development and adoption of environmentally friendly and chlorine-free bleaching alternatives.

Manufacturers explore sustainable and eco-friendly bleaching chemicals to align with changing consumer preferences and regulatory trends.

Rising Demand for Specialty Paper:

The increasing use of specialty papers in packaging, labeling, and hygiene products drives the demand for specific bleaching chemicals catering to the unique requirements of these applications.

Specialty paper production contributes to the diversity of bleaching chemical applications.

Challenges in Handling and Storage:

The handling and storage challenges associated with certain bleaching chemicals, particularly those posing safety and environmental risks, impact their adoption.

Manufacturers and end-users focus on addressing these challenges through improved handling practices and alternative formulations.

Textile Industry Shift towards Bio-Based Alternatives:

The textile industry explores bio-based and enzymatic bleaching alternatives as part of the broader trend toward sustainable and green chemistry.

Bio-based bleaching options aim to reduce the environmental footprint of the textile manufacturing process.

Economic Factors and Industrial Output:

Economic indicators, including GDP growth, industrial output, and manufacturing activities, influence the overall demand for bleaching chemicals across various end-use industries.

Economic trends impact investment decisions, consumer spending, and the production volumes of industries utilizing bleaching agents.

Research and Development Initiatives:

Ongoing research and development efforts focus on innovations in bleaching formulations, aiming to enhance efficiency, reduce environmental impact, and address safety concerns.

Innovations in bleaching technologies contribute to the competitiveness and sustainability of the market.

Global Supply Chain Dynamics:

The bleaching chemicals market is influenced by global supply chain dynamics, trade patterns, and geopolitical factors affecting the availability and pricing of raw materials.

Market participants need to navigate the complexities of the global supply chain to ensure a stable and efficient flow of raw materials and finished products.

Leave a Comment