Technological Advancements

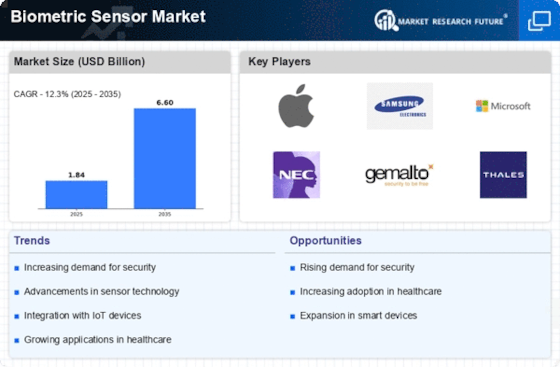

Rapid advancements in technology are significantly influencing the Biometric Sensor Market. Innovations in sensor technology, such as improved accuracy and speed, are enhancing the performance of biometric systems. For instance, the development of 3D facial recognition and fingerprint scanning technologies has made biometric systems more reliable and user-friendly. The market is also witnessing the integration of artificial intelligence and machine learning, which further enhances the capabilities of biometric sensors. These technologies enable real-time data processing and analysis, allowing for quicker and more accurate identification. As a result, the Biometric Sensor Market is expected to expand, with a projected compound annual growth rate (CAGR) of over 20% in the coming years. This growth is indicative of the increasing reliance on biometric solutions across various applications, including personal devices, security systems, and access control.

Increasing Security Concerns

The rising incidence of security breaches and identity theft has heightened the demand for advanced security solutions, thereby propelling the Biometric Sensor Market. Organizations across various sectors are increasingly adopting biometric systems to enhance security protocols. According to recent data, the biometric technology market is projected to reach USD 60 billion by 2025, indicating a robust growth trajectory. This trend is particularly evident in sectors such as banking, healthcare, and government, where safeguarding sensitive information is paramount. The integration of biometric sensors not only mitigates risks but also streamlines access control processes, making them an attractive option for businesses aiming to bolster their security infrastructure. As security concerns continue to escalate, the Biometric Sensor Market is likely to witness sustained growth, driven by the need for reliable and efficient identification methods.

Growing Adoption in Healthcare

The healthcare sector is increasingly recognizing the value of biometric sensors, which is contributing to the expansion of the Biometric Sensor Market. Biometric technology is being utilized for patient identification, ensuring accurate medical records and reducing the risk of fraud. Hospitals and clinics are adopting biometric systems to streamline patient check-in processes and enhance security for sensitive health information. According to industry reports, the healthcare segment is expected to account for a significant share of the biometric market, with a projected growth rate of over 15% annually. This trend reflects a broader movement towards digitization and improved patient care, as biometric solutions facilitate efficient and secure access to medical data. As the healthcare industry continues to evolve, the Biometric Sensor Market is likely to benefit from increased investments in biometric technologies.

Regulatory Compliance and Standards

The implementation of stringent regulations and standards regarding data protection and privacy is driving the growth of the Biometric Sensor Market. Governments and regulatory bodies are increasingly mandating the use of biometric identification systems to ensure secure access to sensitive information. For example, regulations such as the General Data Protection Regulation (GDPR) in Europe have prompted organizations to adopt biometric solutions to comply with legal requirements. This trend is not limited to Europe; many countries are enacting similar laws to protect citizens' data. As organizations strive to meet these compliance standards, the demand for biometric sensors is likely to surge. The Biometric Sensor Market is thus positioned for growth, as businesses seek to implement solutions that not only enhance security but also align with regulatory frameworks.

Rising Demand for Contactless Solutions

The demand for contactless solutions is reshaping the Biometric Sensor Market, particularly in the wake of heightened awareness regarding hygiene and safety. Consumers and organizations are increasingly favoring biometric systems that offer touchless interactions, such as facial recognition and iris scanning. This shift is evident in various sectors, including retail, transportation, and public services, where minimizing physical contact is becoming a priority. Market analysis indicates that the contactless biometric segment is expected to grow at a CAGR of over 25% in the next few years. This trend not only addresses health concerns but also enhances user convenience and efficiency. As the preference for contactless solutions continues to rise, the Biometric Sensor Market is poised for substantial growth, driven by innovations that cater to evolving consumer expectations.