Regulatory Compliance and Standards

Regulatory compliance is emerging as a significant driver for the biometric sensor market. In the US, various regulations mandate the use of biometric technologies for identity verification and access control, particularly in sectors such as finance and healthcare. Compliance with standards such as the National Institute of Standards and Technology (NIST) guidelines is essential for organizations to ensure the security and privacy of sensitive data. As businesses strive to meet these regulatory requirements, the demand for biometric solutions is expected to increase. In 2025, the market could see a substantial rise, with estimates suggesting a growth rate of approximately 15% as organizations prioritize compliance and invest in biometric technologies to safeguard their operations.

Expansion of Mobile and Wearable Devices

The expansion of mobile and wearable devices is a key driver of the biometric sensor market. With the proliferation of smartphones and smartwatches equipped with biometric capabilities, the demand for biometric sensors is on the rise. In 2025, it is anticipated that the market will grow significantly, with mobile devices accounting for a substantial share of biometric sensor applications. The convenience of biometric authentication in mobile payments and health monitoring is appealing to consumers, prompting manufacturers to innovate and enhance their biometric offerings. This trend suggests that as mobile and wearable technologies continue to evolve, the biometric sensor market will likely experience robust growth, driven by consumer preferences for seamless and secure user experiences.

Growing Consumer Awareness and Acceptance

Consumer awareness and acceptance of biometric technologies are significantly influencing the biometric sensor market. As individuals become more familiar with biometric authentication methods, such as facial recognition and fingerprint scanning, the demand for these solutions is likely to rise. Surveys indicate that over 70% of consumers in the US are open to using biometric systems for secure transactions and identity verification. This growing acceptance is encouraging businesses to integrate biometric solutions into their operations, enhancing customer experience and security. In 2025, the market is projected to expand as more consumers recognize the benefits of biometric technologies, leading to increased investments in biometric sensor systems across various sectors.

Rising Demand for Enhanced Security Solutions

There is a notable surge in demand for enhanced security solutions across various sectors in the biometric sensor market. Organizations are increasingly adopting biometric technologies to mitigate security risks associated with traditional authentication methods. In 2025, the market is projected to reach approximately $30 billion, driven by the need for secure access control in financial institutions, government facilities, and healthcare organizations. This trend indicates a shift towards more reliable and efficient security measures. Biometric sensors offer unique advantages such as accuracy and user convenience. The growing awareness of identity theft and data breaches further propels the adoption of biometric systems, making them a critical component in the security infrastructure of businesses and institutions.

Technological Advancements in Biometric Systems

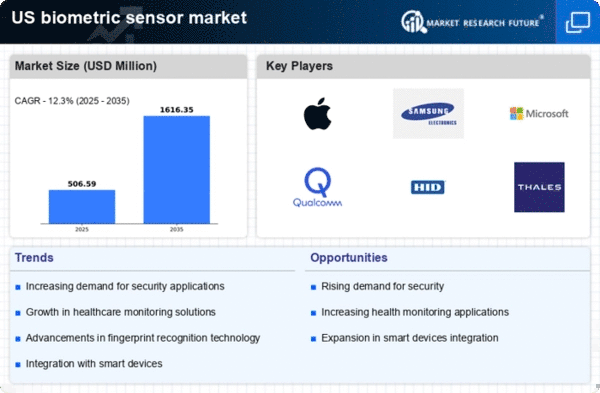

Technological advancements are playing a pivotal role in shaping the biometric sensor market. Innovations in sensor technology, such as improved fingerprint recognition and facial recognition algorithms, are enhancing the accuracy and speed of biometric systems. In 2025, the market is expected to witness a compound annual growth rate (CAGR) of around 20%, largely attributed to these advancements. The integration of artificial intelligence and machine learning into biometric systems is also contributing to their effectiveness, enabling real-time data processing and analysis. As these technologies evolve, they are likely to become more accessible and affordable, further driving the adoption of biometric solutions across various industries, including retail, healthcare, and law enforcement.

.png)