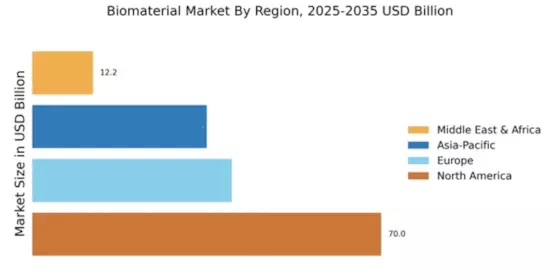

Market Growth Projections

The Global Biomaterials Market Industry is on a trajectory of substantial growth, with projections indicating a market size of 69.4 USD Billion in 2024 and an anticipated increase to 130.5 USD Billion by 2035. This growth is underpinned by a compound annual growth rate of 5.9% from 2025 to 2035, reflecting the increasing integration of biomaterials in various sectors, particularly healthcare. The expansion is driven by factors such as rising healthcare expenditures, technological advancements, and a growing emphasis on sustainable materials. As the market evolves, it is expected to attract further investments and innovations, solidifying its position in the global economy.

Regulatory Support for Biomaterials

Regulatory frameworks are increasingly supportive of the Global Biomaterials Market Industry, facilitating the approval and commercialization of new biomaterials. Agencies are streamlining the approval processes for biocompatible materials, which encourages innovation and expedites market entry. This regulatory environment is particularly beneficial for startups and small enterprises focused on developing novel biomaterials. As regulations evolve to accommodate advancements in technology, the market is likely to experience accelerated growth. The supportive regulatory landscape, combined with rising consumer demand, positions the market for a robust expansion, potentially reaching 69.4 USD Billion in 2024.

Rising Demand for Biocompatible Materials

The Global Biomaterials Market Industry experiences a notable surge in demand for biocompatible materials, driven by their essential role in medical applications. As healthcare providers increasingly prioritize patient safety and comfort, materials such as hydrogels and biodegradable polymers are gaining traction. In 2024, the market is projected to reach 69.4 USD Billion, reflecting a growing preference for materials that minimize adverse reactions. This trend is particularly evident in surgical implants and drug delivery systems, where biocompatibility is paramount. The shift towards these materials indicates a broader movement towards sustainable healthcare solutions, aligning with global health initiatives.

Technological Advancements in Biomaterials

Technological innovations play a crucial role in shaping the Global Biomaterials Market Industry. Advances in material science, such as 3D printing and nanotechnology, enable the development of customized biomaterials tailored to specific medical needs. For instance, 3D-printed scaffolds are revolutionizing tissue engineering by allowing for precise control over porosity and mechanical properties. This adaptability not only enhances the efficacy of implants but also reduces the risk of complications. As these technologies continue to evolve, they are expected to contribute significantly to the market's growth, with projections indicating a rise to 130.5 USD Billion by 2035.

Growing Applications in Regenerative Medicine

The Global Biomaterials Market Industry is witnessing an expansion in applications within regenerative medicine, which focuses on repairing or replacing damaged tissues and organs. Biomaterials such as collagen and chitosan are increasingly utilized in wound healing and tissue regeneration, reflecting a shift towards more effective treatment modalities. The integration of biomaterials in regenerative therapies is expected to enhance patient outcomes and reduce recovery times. As the field progresses, the demand for innovative biomaterials is likely to rise, contributing to a projected compound annual growth rate of 5.9% from 2025 to 2035, underscoring the market's potential.

Increasing Investment in Research and Development

Investment in research and development is a pivotal driver of the Global Biomaterials Market Industry. Governments and private entities are allocating substantial resources to explore new biomaterials and their applications. This influx of funding fosters innovation and accelerates the development of advanced materials that meet the evolving needs of healthcare. For example, initiatives aimed at developing bioactive materials for orthopedic applications are gaining momentum, reflecting a commitment to enhancing patient care. As R&D efforts intensify, the market is poised for significant growth, with projections indicating a market size of 130.5 USD Billion by 2035.