Advancements in Biotechnology

Technological advancements in biotechnology are propelling the Biologic Therapy Market forward. Innovations in genetic engineering, monoclonal antibody production, and cell-based therapies are enhancing the efficacy and safety profiles of biologic drugs. The development of novel biologics, including CAR-T cell therapies and gene therapies, showcases the potential for groundbreaking treatments. Market data suggests that the biotechnology sector is experiencing robust growth, with investments in research and development reaching new heights. This influx of innovation is likely to drive the Biologic Therapy Market, as new therapies emerge to address unmet medical needs and improve patient outcomes.

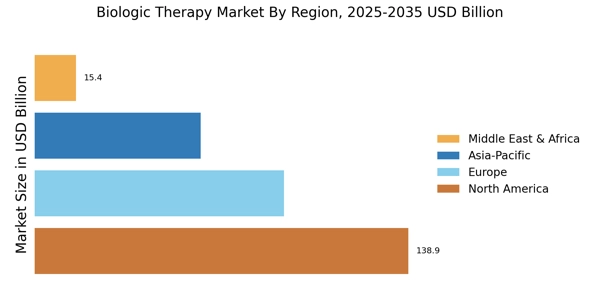

Increasing Healthcare Expenditure

Rising healthcare expenditure across various regions is a significant driver of the Biologic Therapy Market. As countries allocate more resources to healthcare, there is a corresponding increase in the availability and accessibility of advanced therapies, including biologics. This trend is particularly pronounced in developed economies, where healthcare budgets are expanding to accommodate innovative treatments. Market Research Future suggest that the growth in healthcare spending is likely to continue, providing a favorable environment for the Biologic Therapy Market. As more patients gain access to biologic therapies, the market is expected to experience robust growth, reflecting the increasing prioritization of advanced medical solutions.

Rising Demand for Targeted Therapies

The shift towards targeted therapies is reshaping the landscape of the Biologic Therapy Market. Patients and healthcare providers are increasingly favoring treatments that specifically target disease mechanisms, leading to improved efficacy and reduced side effects. This trend is particularly evident in oncology, where targeted biologics are becoming the standard of care for various cancers. Market data indicates that the demand for targeted therapies is expected to grow significantly, driven by advancements in precision medicine. As the Biologic Therapy Market adapts to this demand, it is likely to see a proliferation of new products designed to meet the needs of patients seeking personalized treatment options.

Growing Prevalence of Chronic Diseases

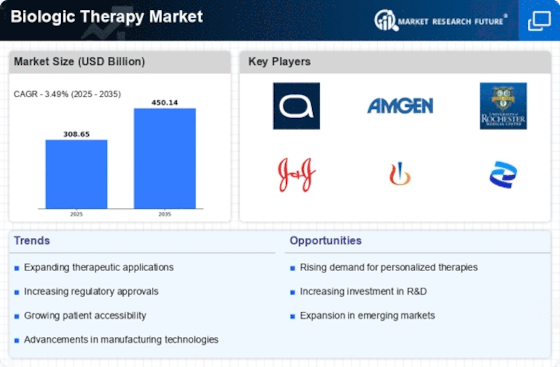

The increasing incidence of chronic diseases such as rheumatoid arthritis, psoriasis, and inflammatory bowel disease is a primary driver of the Biologic Therapy Market. As these conditions become more prevalent, the demand for effective treatment options rises. According to recent data, the prevalence of autoimmune diseases has been steadily increasing, leading to a surge in the utilization of biologic therapies. This trend is expected to continue, with projections indicating that the market for biologic therapies could reach substantial figures in the coming years. The Biologic Therapy Market is thus positioned to expand significantly as healthcare providers seek innovative solutions to manage these complex diseases.

Regulatory Support and Streamlined Approval Processes

Regulatory agencies are increasingly supporting the development of biologic therapies, which is a crucial factor for the Biologic Therapy Market. Initiatives aimed at expediting the approval process for biologics, such as the FDA's Breakthrough Therapy designation, are encouraging pharmaceutical companies to invest in biologic research. This regulatory environment fosters innovation and allows for faster access to new therapies for patients. Market analysis indicates that the number of biologics receiving approval has been on the rise, reflecting a favorable trend for the Biologic Therapy Market. As regulatory pathways become more efficient, the market is likely to witness accelerated growth.