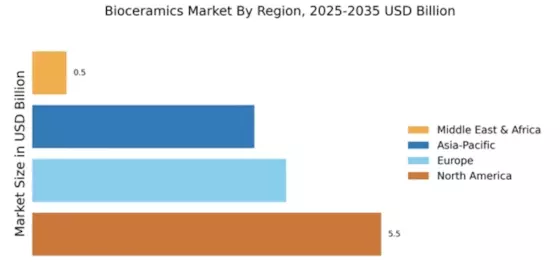

Market Growth Projections

The Global Bioceramics Market Industry is projected to experience substantial growth in the coming years, with estimates indicating a market size of 13.5 USD Billion in 2024 and a remarkable increase to 34.3 USD Billion by 2035. This growth trajectory suggests a robust demand for bioceramic materials across various sectors, particularly in healthcare applications. The anticipated CAGR of 8.8% from 2025 to 2035 highlights the industry's potential for expansion, driven by technological advancements, increasing applications, and a growing awareness of the benefits of bioceramics. Such projections underscore the importance of ongoing research and innovation in this dynamic market.

Increasing Geriatric Population

The Global Bioceramics Market Industry is significantly influenced by the increasing geriatric population, which requires advanced medical solutions for age-related health issues. As the global population ages, the demand for orthopedic and dental implants rises, driving the need for bioceramic materials known for their durability and biocompatibility. By 2035, the market is anticipated to expand to 34.3 USD Billion, underscoring the urgency for innovative solutions in elder care. This demographic shift necessitates a focus on developing bioceramics that cater to the specific needs of older patients, thereby enhancing their quality of life.

Rising Demand for Biocompatible Materials

The Global Bioceramics Market Industry experiences a notable increase in demand for biocompatible materials, driven by advancements in medical technology. As healthcare providers seek materials that promote better integration with human tissues, bioceramics are becoming increasingly favored for applications such as dental implants and orthopedic devices. The market is projected to reach 13.5 USD Billion in 2024, reflecting a growing recognition of the benefits these materials offer. This trend indicates a shift towards more sustainable and effective medical solutions, positioning bioceramics as a critical component in the future of healthcare.

Technological Advancements in Bioceramics

Technological innovations play a pivotal role in the Global Bioceramics Market Industry, enhancing the performance and applications of bioceramics. Recent developments in manufacturing techniques, such as additive manufacturing and improved sintering processes, have led to the creation of more complex and functional bioceramic structures. These advancements enable the production of customized implants that better meet patient needs. As a result, the market is expected to grow significantly, with projections indicating a CAGR of 8.8% from 2025 to 2035. This growth reflects the industry's commitment to integrating cutting-edge technology into bioceramic applications.

Regulatory Support and Standards Development

Regulatory support and the establishment of standards are crucial for the Global Bioceramics Market Industry, as they ensure the safety and efficacy of bioceramic products. Government agencies and industry associations are actively involved in creating guidelines that facilitate the approval process for new bioceramic materials. This regulatory framework not only enhances consumer confidence but also encourages innovation within the industry. As regulations evolve to accommodate emerging technologies, the market is likely to benefit from increased investment and research, fostering a conducive environment for growth and development.

Growing Applications in Orthopedics and Dentistry

The Global Bioceramics Market Industry is witnessing a surge in applications within orthopedics and dentistry, where bioceramics are increasingly utilized for their superior properties. In orthopedics, bioceramics are employed in bone grafts and joint replacements, while in dentistry, they are used for dental implants and restorative procedures. The versatility of bioceramics makes them suitable for a wide range of applications, contributing to the market's growth. As healthcare providers continue to adopt these materials for their effectiveness and safety, the industry is poised for substantial expansion, driven by ongoing research and development efforts.