Bioceramics Size

Bioceramics Market Growth Projections and Opportunities

The Bioceramics market is influenced by a myriad of factors that collectively shape its dynamics. One crucial market factor is the increasing prevalence of chronic diseases and the growing aging population. As people age, there is a rising demand for medical interventions, including bioceramic-based implants and devices. Bioceramics, with their biocompatible and osteoconductive properties, are gaining prominence in orthopedic and dental applications, driving market growth.

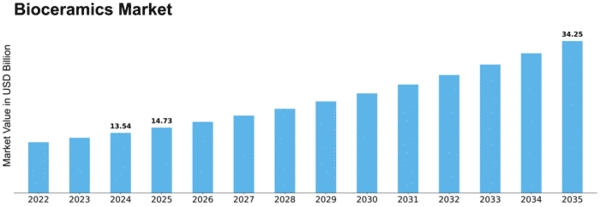

Bioceramics Market Size was valued at USD 11.2 Billion in 2022. The Bioceramics industry is projected to grow from USD 12.3 Billion in 2023 to USD 26.6 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 10.10%

Technical advancements are central to the changing situation of the market of Bioceramics. An area of active scientific research and technological development, the identification of materials with excellent features such as increased strength, durability, and bioactivity, is the leading trend. Thus, these innovations not only help to open up the scope of applications but also contribute to the overall market competitiveness as well.

The question of environmeal issues recently became increasingly important in bioceramics market. The focus on sustainability and ecologically composed materials is the catalyst for the obtainment of the bioceramics made from renewable sources. The advancement of bioceramic technology is based on creating materials from nature that not only tackle environmental problems but they also answer the market of consumers who opt for green living.

A number of elements including economic factors at global level and healthcare expenditure pattern too determine the magnitude of BioCeramics market. Economic growth, especially in the emerging markets, spurs increased spending on healthcare, the desire for advanced bioceramics and other similar advanced medical technologies being the reason for such growth in demand. On the other hand, market stagnation and growth rate decrease is an inevitable result of decrease in the health budget that may follow economic crises.

A regulatory landscape and compliance standards are serious considerations that can determine the pace of development and commercialization of bioceramic products. Regulatory restrictions for medical devices (including implants) such as time-demanding evaluation procedures and certification are the crucial factors affecting the timeframes of introducing and marketing new products of manufacturers.

Co-operations and partnerships in the field of healthcare industry support the expansion of such markets by creating innovations and improving the most efficient development method of the bioceramic particular solutions. A link among research institutes, pharmaceutical firms, and medical device producers, touching on patent-licensing contributes largely to the transformation of the scientific insights into marketable products, fostering the expansion of the Bioceramics market.

Besides the stated fact that consumer behavior and preferences have also got a place among the factors behind the development of the Bioceramics market. As a consequence, people are increasingly educated about the roles of bioceramics in health care and the general demand for these materials is on the increase. Strategies that enhance and inform the predictable advantages of bioceramics are the core ingredients to increasing market shares.

Through the arena of the competitive landscape, and market dynamics, are expressed with such factors as mergers and acquisitions. The important associations and mergers of the players in the bioceramics industry influence the distribution of market shares, pricing policy, and the level of competition among the companies. Those companies which manage to thread the needle of these moves well may find a firmer ground for their market position.

Leave a Comment