Regulatory Support

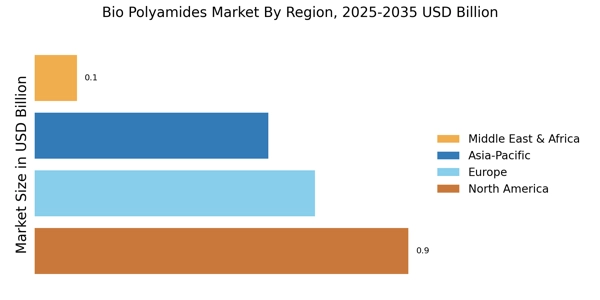

Regulatory support is emerging as a significant driver for the Bio Polyamides Market. Governments worldwide are implementing stringent regulations aimed at reducing carbon footprints and promoting the use of bio-based materials. Policies that incentivize the use of renewable resources and penalize excessive reliance on fossil fuels are fostering a favorable environment for bio polyamide adoption. Market data indicates that regions with robust regulatory frameworks are witnessing a surge in bio polyamide production, with a projected increase of 20% in market share over the next decade. This regulatory landscape not only encourages manufacturers to invest in bio polyamide technologies but also enhances consumer confidence in these sustainable alternatives. As regulations continue to evolve, the bio polyamide market is likely to benefit from increased demand and investment.

Technological Innovations

Technological innovations play a crucial role in shaping the Bio Polyamides Market. Advances in polymerization techniques and biotechnological processes have led to the development of high-performance bio polyamides with enhanced properties. For instance, the introduction of enzymatic processes for the production of bio polyamides has improved efficiency and reduced waste. Market data suggests that the adoption of these technologies is expected to increase production capacity by 15% in the coming years. Furthermore, innovations in processing methods allow for better integration of bio polyamides into existing manufacturing systems, thereby expanding their applicability across various sectors. As manufacturers seek to optimize production and reduce costs, the continuous evolution of technology in the bio polyamide sector is likely to drive significant growth.

Sustainability Initiatives

The increasing emphasis on sustainability initiatives is a pivotal driver for the Bio Polyamides Market. As consumers and manufacturers alike become more environmentally conscious, the demand for sustainable materials rises. Bio polyamides, derived from renewable resources, offer a viable alternative to traditional petroleum-based polyamides. This shift is reflected in market data, indicating that the bio-based polyamide segment is projected to grow at a compound annual growth rate of approximately 8% over the next five years. Companies are investing in research and development to enhance the properties of bio polyamides, making them suitable for various applications, including textiles and automotive components. The alignment of bio polyamides with sustainability goals not only meets regulatory requirements but also appeals to eco-conscious consumers, thereby driving market growth.

Expanding Applications in Textiles

The expanding applications of bio polyamides in the textiles industry represent a significant driver for the Bio Polyamides Market. With the fashion and apparel sectors increasingly prioritizing sustainability, bio polyamides are gaining traction as a preferred material for clothing and accessories. These materials offer desirable properties such as durability, moisture-wicking, and biodegradability, making them suitable for a wide range of textile applications. Market data indicates that the demand for bio polyamides in textiles is projected to grow by 12% annually, driven by consumer preferences for eco-friendly products. As brands seek to enhance their sustainability profiles, the incorporation of bio polyamides into textile production is likely to become more prevalent, thereby propelling market growth.

Growing Demand in Automotive Sector

The automotive sector's growing demand for lightweight and sustainable materials is a key driver for the Bio Polyamides Market. As manufacturers strive to enhance fuel efficiency and reduce emissions, the use of bio polyamides in automotive applications is becoming increasingly prevalent. These materials offer excellent mechanical properties and thermal resistance, making them suitable for various automotive components. Market data reveals that the automotive segment is expected to account for over 30% of the total bio polyamide consumption by 2026. This trend is further supported by automotive manufacturers' commitments to sustainability, as they seek to replace traditional materials with bio-based alternatives. The integration of bio polyamides into automotive design not only meets regulatory standards but also aligns with consumer preferences for greener vehicles.