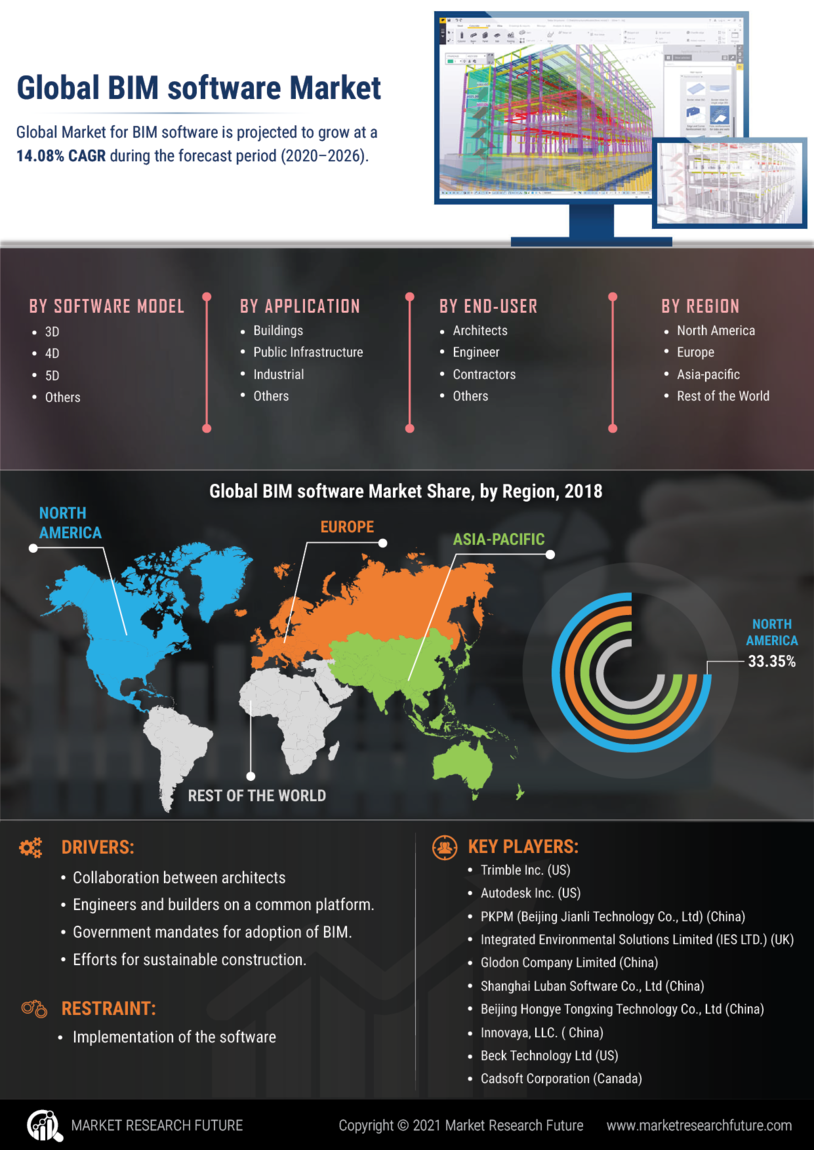

BIM Software Market Summary

As per Market Research Future analysis, the BIM Software Market Size was estimated at 11.15 USD Billion in 2024. The BIM Software industry is projected to grow from 12.81 USD Billion in 2025 to 51.36 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 14.9% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The BIM Software Market is experiencing robust growth driven by technological advancements and increasing demand for efficient project management.

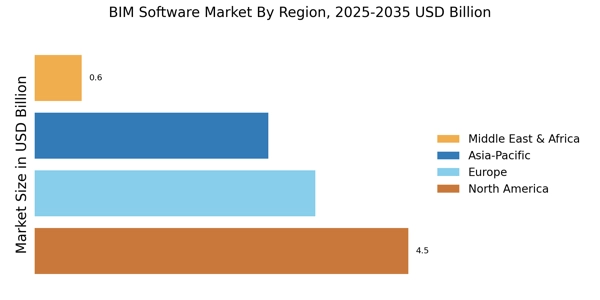

- The North American region remains the largest market for BIM software, reflecting a strong adoption across various sectors.

- Asia-Pacific is emerging as the fastest-growing region, propelled by rapid urbanization and infrastructure development.

- The 3D segment continues to dominate the market, while the 4D segment is witnessing the highest growth rate due to its enhanced project management capabilities.

- Key market drivers include rising demand for efficient project management and increased investment in infrastructure development.

Market Size & Forecast

| 2024 Market Size | 11.15 (USD Billion) |

| 2035 Market Size | 51.36 (USD Billion) |

| CAGR (2025 - 2035) | 14.9% |

Major Players

Autodesk (US), Bentley Systems (US), Trimble (US), Nemetschek (DE), Graphisoft (HU), Dassault Systèmes (FR), RIB Software (DE), Siemens (DE), AVEVA (GB)