Beverage Cartons Size

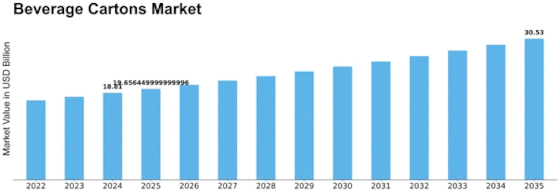

Beverage Cartons Market Growth Projections and Opportunities

Numerous countries are implementing strict regulations aimed at reducing single-use plastics as well as promoting sustainable packaging materials alternatives which should be used instead. Hence beverage producers are having to investigate and invest in carton packs so as to conform with such legislations and improve on their corporate sustainability profiles as well . Consequently, a steady rise is expected for beverage carton demand due to governments’ focus on environmental conservation.

Additionally, innovation and technological advancements contribute towards changing the face of the Beverage Cartons Market today (Beverage Cartons). Manufacturers are focusing on research and development (R&D) investments targeted at the development of improved carton packaging solutions with longer shelf life, better protection against external conditions and enhanced user convenience among other things. Aseptic packing technology is an example of such improvements that now enable beverages to last longer without preservatives hence fitting into new preferences of the population that require healthy products.

Market dynamics also depend on economic factors affecting the beverage industry (Bevnet.com). For instance changes in prices of raw materials, energy costs or general economic situations may affect the manufacture and pricing of beverage cartons. Moreover, customers’ disposable income affects their purchasing power and thus the demand for packaged drinks (Beverage Carton). The higher population can be able to spend from their own pockets when they purchase beverages that have been packed in cardboard rather than plastic packages. In a nutshell, any economic growth or stability is bound to push forward the ever-expanding Beverage Cartons Market.

The market landscape is also influenced by industry’s competitive forces. The reason behind this is because the presence of key players, marketing strategies that they employ as well as product innovations all contribute to how competitive the market is (Beverage cartons: A sustainable packaging solution). This has led to strategic collaboration, merger and acquisition activities within the beverage packaging industry which have affected market structure while increasing competition. Competing companies are offering different designs on carton packs such as aesthetics, user-friendly features or easy opening/closing systems.

In addition global developments in demography impact on Beverage Cartons Market (Beverage Carton Packaging: Global Industry Analysis). For example, population growth rates, urbanization levels and changes in people’s lifestyles all lead to alteration of consumer preference towards convenience-oriented packaging including; on-the-go. With rising urbanization and an increasingly fast-paced life for many individuals who move into cities, there will be more demand for easily carried lightweight beverage cartons. Indeed this trend is so common especially in emerging markets where rapid urbanization goes hand-in-hand with a surging middle class which prefers packaged and convenient goods.

Leave a Comment