- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

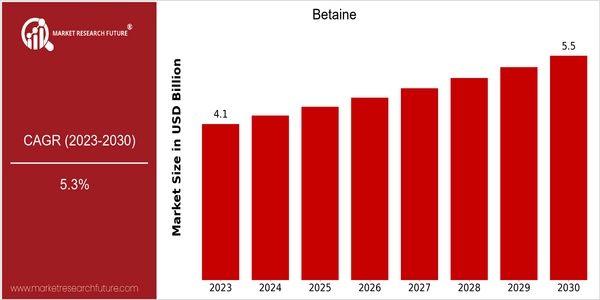

| Year | Value |

|---|---|

| 2023 | USD 4.1 Billion |

| 2030 | USD 5.5 Billion |

| CAGR (2023-2030) | 5.3 % |

Note – Market size depicts the revenue generated over the financial year

The betaine market is valued at $ 4.1 billion in 2023 and is expected to reach $ 5.5 billion by the year 2030. This growth trend reflects a steady increase in the demand for betaine, especially in the food and beverage, cosmetics, and animal feed industries. The rising awareness of health and the increasing demand for natural and organic products have significantly contributed to the expansion of the market. Also, the use of betaine as a dietary supplement has been increasing, owing to its beneficial properties, such as its hydration and metabolism-promoting effects. Also, technological advancements in extraction and production have made high-quality betaine available. Leading companies such as BASF SE, DuPont, and Amino GmbH are investing heavily in research and development and strategic alliances to enhance their market position. Recent product launches, for example, focusing on plant-based betaine, are addressing the growing demand for sustainable and eco-friendly products, thereby contributing to the expansion of the market.

Regional Market Size

Regional Deep Dive

Betaine Market is a growing market for a number of regions, driven by the increasing demand from the food and beverage, personal care, and agricultural sectors. In North America, the market is characterized by the strong emphasis on health and health, and the rising use of betaine as a health ingredient. In Europe, the regulatory framework for the use of betaine in food supplements is strong. In Asia-Pacific, the rapid urbanization and industrialization process is boosting the demand for betaine in various applications. In the Middle East and Africa, the use of betaine in agriculture is gradually increasing, while in Latin America, the focus is on sustainable development and the use of betaine in the food industry.

Europe

- The European Food Safety Authority (EFSA) has approved several health claims related to betaine, particularly its role in liver health, which is driving its incorporation into dietary supplements.

- Companies such as Evonik Industries are focusing on sustainable sourcing of betaine, aligning with the EU's Green Deal initiatives aimed at promoting environmentally friendly practices.

Asia Pacific

- The growing trend of health consciousness among consumers in countries like China and India is leading to increased demand for betaine in functional foods and beverages.

- Innovations in betaine extraction methods by companies like Kemin Industries are making it more accessible and cost-effective for manufacturers in the region.

Latin America

- Brazil is witnessing a surge in the use of betaine in the food industry, driven by consumer demand for natural and functional ingredients.

- Local companies are increasingly focusing on the sustainable production of betaine, aligning with the region's growing emphasis on eco-friendly practices.

North America

- The U.S. Food and Drug Administration (FDA) has recognized betaine as Generally Recognized As Safe (GRAS), which has encouraged its use in food products and supplements, leading to increased market penetration.

- Key players like BASF and DuPont are investing in research and development to innovate betaine production processes, enhancing product quality and sustainability.

Middle East And Africa

- The adoption of betaine in agricultural applications is gaining traction, with initiatives from organizations like the International Center for Biosaline Agriculture promoting its use to enhance crop yield in arid regions.

- Government programs aimed at improving food security are encouraging the use of betaine in livestock feed, which is expected to boost its demand in the region.

Did You Know?

“Betaine is not only found in sugar beets but also in various foods such as spinach, quinoa, and shellfish, making it a versatile ingredient in many diets.” — USDA National Nutrient Database

Segmental Market Size

In the food and beverage industry the betaine market is currently growing at a steady rate, driven by the ever-increasing demand for natural ingredients and clean label products. Beside the well-known betaine health benefits such as the reduction of homocysteine and the improvement of the metabolism, a strong driving force for this growth is the growing awareness of the role of betaine in the prevention of diseases such as diabetes. Also, regulatory developments favouring the use of natural substances over synthetic ones are favourable for the betaine market. Betaine use in food and beverages is currently at a mature stage, with DuPont and BASF being the market leaders. In the feed industry betaine is used as a performance enhancing and health promoting ingredient. Beside the known betaine health benefits, the trend towards sustainable and clean label products and the growing health consciousness of consumers are expected to further drive this growth. Also, the development of betaine extraction processes such as the fermentation method will play a role in the future development of the market, resulting in a more sustainable and efficient production method.

Future Outlook

The market for betaine is expected to grow at a fast pace from 2023 to 2030. The market is expected to grow from $4.1 billion to $5.5 billion at a CAGR of 5.3%. This growth is driven by the increasing demand for natural and plant-based ingredients in the food, beverage, and cosmetics industries. In addition, the growing awareness of consumers about the benefits of dietary supplements and sports nutrition products will continue to increase the demand for betaine. The main technological changes and policy drivers will shape the betaine market. The development of extraction and production processes has made betaine a more sustainable and efficient product, which has made it more accessible to manufacturers. The support of the government for natural ingredients in food and cosmetics is expected to further increase the penetration of the market. The growing popularity of vegan and clean label products will also increase the demand for betaine, as they meet consumers' demand for transparency and health benefits. By 2030, betaine is expected to reach a penetration rate of 15% in the global food and beverage industry, and will be firmly established as an important ingredient in health-oriented products.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 5.30% (2023-2030) |

Betaine Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.