Growing Renewable Energy Sector

The expansion of the renewable energy sector is significantly influencing the Battery Materials Market. As the world shifts towards cleaner energy sources, the need for energy storage solutions becomes increasingly vital. Battery systems are essential for storing energy generated from solar and wind sources, ensuring a reliable power supply. The energy storage market is projected to grow at a CAGR of approximately 25% over the next few years, driving demand for battery materials. This trend highlights the interconnection between renewable energy and battery technologies, positioning the Battery Materials Market as a key player in the transition to sustainable energy systems.

Government Policies and Incentives

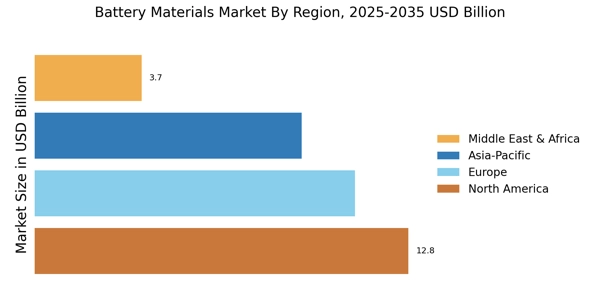

Government policies and incentives play a crucial role in shaping the Battery Materials Market. Many countries are implementing regulations aimed at reducing carbon emissions and promoting renewable energy sources. For example, tax credits and subsidies for EV purchases encourage consumers to transition to electric vehicles, thereby increasing the demand for battery materials. Additionally, governments are investing in domestic production of critical minerals to reduce reliance on imports. This strategic focus on local sourcing is expected to bolster the Battery Materials Market, as it creates a more stable supply chain and fosters innovation in material extraction and processing.

Rising Demand for Electric Vehicles

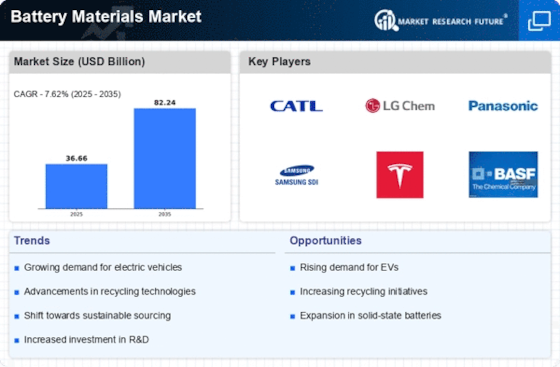

The increasing adoption of electric vehicles (EVs) is a primary driver for the Battery Materials Market. As consumers and governments prioritize sustainability, the demand for EVs is projected to rise significantly. According to recent data, the EV market is expected to grow at a compound annual growth rate (CAGR) of over 20% through the next decade. This surge in EV production necessitates a corresponding increase in battery materials, such as lithium, cobalt, and nickel, which are essential for high-performance batteries. Consequently, manufacturers are investing heavily in sourcing these materials to meet the anticipated demand. The Battery Materials Market is thus positioned to experience substantial growth as it aligns with the automotive sector's transition towards electrification.

Technological Innovations in Battery Chemistry

Technological advancements in battery chemistry are reshaping the Battery Materials Market. Innovations such as solid-state batteries and lithium-sulfur technologies promise to enhance energy density and safety while reducing costs. For instance, solid-state batteries could potentially offer energy densities exceeding 300 Wh/kg, compared to traditional lithium-ion batteries. This shift not only improves battery performance but also drives the demand for new materials and components. As research and development efforts continue to evolve, the Battery Materials Market is likely to witness a transformation in material requirements, leading to new opportunities for suppliers and manufacturers alike.

Increased Focus on Recycling and Circular Economy

The growing emphasis on recycling and the circular economy is emerging as a significant driver for the Battery Materials Market. As battery production escalates, so does the need for sustainable practices in material usage. Recycling initiatives aim to recover valuable materials from spent batteries, such as lithium and cobalt, thereby reducing environmental impact and resource depletion. Recent studies indicate that recycling could supply a substantial portion of the materials needed for future battery production. This shift towards a circular economy not only enhances sustainability but also creates new business opportunities within the Battery Materials Market, as companies seek to innovate in recycling technologies and processes.