Government Policies and Incentives

Government policies and incentives aimed at promoting clean energy and electric mobility are playing a crucial role in shaping the Lithium-Ion Battery Material Market. Many governments are implementing regulations that encourage the adoption of electric vehicles and renewable energy solutions, often accompanied by financial incentives for consumers and manufacturers. For example, tax credits for EV purchases and subsidies for battery production are becoming increasingly common. These initiatives not only stimulate demand for lithium-ion batteries but also create a favorable environment for investment in battery material production. As a result, the Lithium-Ion Battery Material Market is likely to experience robust growth, driven by supportive governmental frameworks that prioritize sustainability and technological advancement.

Growing Consumer Electronics Market

The burgeoning consumer electronics market is another significant driver of the Lithium-Ion Battery Material Market. With the proliferation of smartphones, laptops, tablets, and wearable devices, the demand for portable power sources is escalating. Lithium-ion batteries are the preferred choice for these applications due to their lightweight nature and high energy capacity. Market Research Future indicates that the consumer electronics sector is expected to witness substantial growth, with billions of devices projected to be sold annually. This trend not only fuels the demand for lithium-ion batteries but also necessitates a continuous supply of battery materials. As consumer preferences shift towards more advanced and efficient electronic devices, the Lithium-Ion Battery Material Market is poised for sustained expansion.

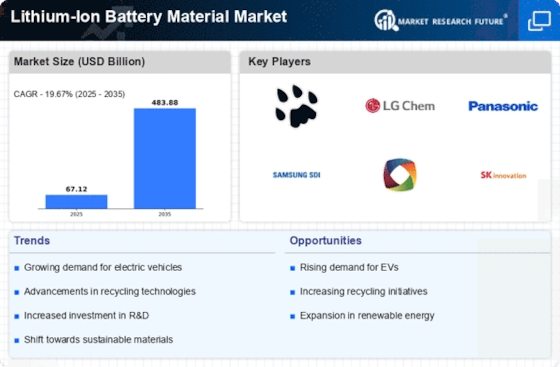

Rising Demand for Electric Vehicles

The increasing adoption of electric vehicles (EVs) is a primary driver for the Lithium-Ion Battery Material Market. As consumers and manufacturers alike prioritize sustainability, the demand for EVs is projected to rise significantly. According to recent estimates, the EV market is expected to grow at a compound annual growth rate (CAGR) of over 20% through the next decade. This surge in EV production necessitates a corresponding increase in lithium-ion batteries, which are essential for powering these vehicles. Consequently, the demand for high-quality battery materials, such as lithium, cobalt, and nickel, is likely to escalate. This trend not only supports the growth of the Lithium-Ion Battery Material Market but also encourages innovation in battery technology, leading to more efficient and longer-lasting batteries.

Expansion of Renewable Energy Storage Solutions

The transition towards renewable energy sources, such as solar and wind, is driving the need for efficient energy storage solutions, thereby impacting the Lithium-Ion Battery Material Market. As renewable energy generation becomes more prevalent, the demand for batteries that can store excess energy for later use is increasing. Lithium-ion batteries are favored for their high energy density and efficiency, making them ideal for this application. Market analysts project that the energy storage market will reach a valuation of several billion dollars in the coming years, with lithium-ion batteries accounting for a substantial share. This growth in energy storage solutions not only bolsters the Lithium-Ion Battery Material Market but also aligns with global efforts to reduce carbon emissions and enhance energy sustainability.

Technological Innovations in Battery Manufacturing

Technological advancements in battery manufacturing processes are significantly influencing the Lithium-Ion Battery Material Market. Innovations such as solid-state batteries and improved recycling techniques are enhancing the performance and sustainability of lithium-ion batteries. For instance, solid-state batteries promise higher energy densities and improved safety compared to traditional lithium-ion batteries. Furthermore, advancements in recycling technologies are enabling the recovery of valuable materials from used batteries, thus reducing the need for new raw materials. This not only supports the Lithium-Ion Battery Material Market by ensuring a steady supply of materials but also addresses environmental concerns associated with battery disposal. As these technologies continue to evolve, they are likely to reshape the landscape of battery production and usage.