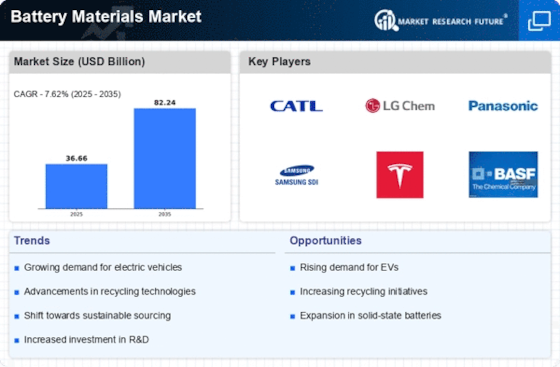

Top Industry Leaders in the Battery Material Market

The quest for cleaner, more efficient energy storage has propelled the battery materials market to electrifying heights. But who are the key players vying for dominance, and what strategies are they wielding to conquer this charged territory? Let's delve into the dynamic landscape of battery materials.

The quest for cleaner, more efficient energy storage has propelled the battery materials market to electrifying heights. But who are the key players vying for dominance, and what strategies are they wielding to conquer this charged territory? Let's delve into the dynamic landscape of battery materials.

Key Players and Winning Plays:

-

Global Giants: Mining behemoths like BHP Billiton, Glencore, and Lithium Americas control access to critical raw materials like lithium, cobalt, and nickel, giving them a dominant foothold. BHP, for instance, recently acquired a major stake in a Chilean lithium mine, solidifying its supply chain.

-

Material Masters: Companies like Panasonic, LG Chem, and Samsung SDI hold sway in the production of cathode and anode materials, with their vertically integrated operations and advanced manufacturing processes offering a competitive edge. LG Chem, for example, boasts a diverse portfolio of battery materials catering to various applications.

-

Tech Titans: Tesla, with its in-house battery R&D and production, disrupts the market with innovative approaches like utilizing recycled materials and exploring new battery chemistries. Their Gigafactories serve as model production hubs for the industry.

-

Sustainable Champions: Emerging players like Redwood Materials and American Manganese Inc. are carving a niche by focusing on recycling and repurposing spent batteries, addressing growing concerns about resource scarcity and environmental impact. Redwood, spearheaded by Elon Musk, aims to establish a closed-loop lithium battery system.

Factors Shaping Market Share:

-

Securing Raw Materials: Ensuring stable and ethical sourcing of critical minerals like lithium is crucial for long-term success. Diversifying supply chains and exploring alternative materials are key strategies.

-

Technological Innovation: Constant research and development of new battery chemistries, with higher energy density, faster charging times, and enhanced safety, is vital for staying ahead of the curve. Tesla's focus on lithium-iron-phosphate batteries is a case in point.

-

Sustainability and Recycling: Integrating environmentally friendly practices throughout the battery lifecycle, from extraction to recycling, is crucial for gaining consumer and regulatory approval. Initiatives like Redwood's closed-loop system are shaping the future.

-

Cost Optimization and Efficiency: Finding cost-effective ways to extract, process, and manufacture battery materials is critical for market penetration, particularly in cost-sensitive segments like consumer electronics. Streamlining production and utilizing automation are key tactics.

Key Companies in the battery materials market include

- 3M (US)

- BASF SE (Germany)

- DowDuPont (US)

- Celgard LLC (US)

- Solvay (Belgium)

- Mitsubishi Chemical Corporation (Japan)

- Entek (UK)

- Ecopro (South Korea)

- Hitachi Chemical Co. Ltd (Japan)

- Nippon Denko Co.Ltd (Japan)

Recent Developments

June 2022: Umicore and Idemitsu Kosan Co., Ltd have agreed to collaborate on developing high-performance catholyte materials for solid-state batteries, combining their expertise in active cathode materials and solid electrolytes to provide the technological breakthrough required to extend the driving range and thus propel e-mobility.

November 2021: NEO Battery Materials Ltd. introduces three key varieties of silicon anode active materials, namely NBMSiDE-P200, NBMSiDE-C100, and NBMSiDE-P100, with plans to begin production of these battery materials by the end of 2022. By securing the product pipelines for these silicon anode materials, NEO will respond more quickly and efficiently to the multiple requirements of battery materials compatible with the lithium-ion battery cell system.

Tesla declared its intention to construct a lithium refinery in Texas during January 2023; the facility will churn out quantities of Lithium Hydroxide used extensively within Li-ion batteries production.

November 2021- SES, a leading developer and maker of hybrid lithium-metal rechargeable batteries for electric vehicles (EVs), introduced Apollo. At 107 Ah, it is the world’s most extensive Li-Metal battery and is considered a significant advancement in the automotive industry.

The second anode materials facility was completed in Sejong, South Korea thereby increasing manufacturing capacity for POSCO Chemicals’ anode materials on July 29th, 2020.