Growing Cybersecurity Concerns

Growing cybersecurity concerns are a critical driver in the Banking System Software Market. As financial institutions increasingly digitize their operations, the risk of cyber threats has escalated, prompting a heightened focus on security measures. Banks are investing in advanced software solutions that incorporate robust cybersecurity features to protect sensitive customer data and maintain trust. Recent statistics indicate that cyberattacks on financial institutions have surged, leading to significant financial losses and reputational damage. In response, the demand for banking software that offers comprehensive security protocols is likely to increase. This trend underscores the importance of integrating cybersecurity into the core functionalities of banking systems, thereby driving growth in the Banking System Software Market as institutions prioritize safeguarding their operations.

Emergence of Fintech Partnerships

The emergence of fintech partnerships is significantly impacting the Banking System Software Market. Traditional banks are increasingly collaborating with fintech companies to leverage their technological expertise and innovative solutions. This trend is driven by the need to enhance service offerings and improve operational efficiency. As of 2025, it is estimated that partnerships between banks and fintech firms will continue to grow, leading to the development of hybrid banking solutions that combine the strengths of both sectors. Such collaborations enable banks to access cutting-edge technologies, such as artificial intelligence and blockchain, which can enhance their software capabilities. Consequently, the Banking System Software Market is likely to see a rise in demand for integrated solutions that facilitate these partnerships, allowing banks to remain competitive in a rapidly evolving landscape.

Shift Towards Open Banking Models

The shift towards open banking models is transforming the Banking System Software Market. Open banking allows third-party developers to access financial institutions' data through application programming interfaces (APIs), fostering innovation and competition. This trend is gaining traction as consumers demand more personalized and flexible banking solutions. As of 2025, the adoption of open banking is expected to accelerate, leading to the development of new software applications that enhance customer experiences. Financial institutions are recognizing the potential of open banking to create value-added services and improve customer engagement. Consequently, the Banking System Software Market is likely to witness increased demand for software solutions that support open banking initiatives, enabling banks to collaborate with fintechs and other service providers to deliver innovative financial products.

Digital Transformation Initiatives

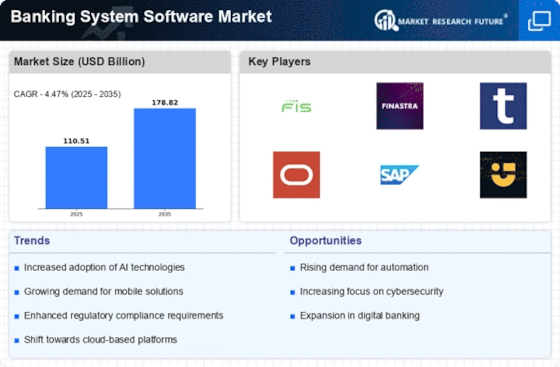

Digital transformation initiatives are reshaping the Banking System Software Market, as financial institutions strive to enhance operational efficiency and customer engagement. The shift towards digital banking services has led to an increased demand for innovative software solutions that facilitate online transactions, mobile banking, and personalized customer experiences. According to recent data, the digital banking sector is expected to witness substantial growth, with a projected increase in user adoption rates. This trend compels banks to invest in modern software systems that can support digital channels and provide seamless integration with existing infrastructure. As a result, the Banking System Software Market is likely to experience a surge in demand for solutions that enable digital transformation, ultimately leading to improved customer satisfaction and loyalty.

Regulatory Compliance Requirements

The Banking System Software Market is increasingly influenced by stringent regulatory compliance requirements. Financial institutions are mandated to adhere to various regulations, such as anti-money laundering (AML) and know your customer (KYC) guidelines. This necessitates the adoption of sophisticated banking software solutions that can ensure compliance and mitigate risks. As of 2025, the market for compliance-related software is projected to grow significantly, driven by the need for real-time monitoring and reporting capabilities. Institutions are investing in advanced technologies to automate compliance processes, thereby reducing operational costs and enhancing efficiency. The demand for software that can seamlessly integrate compliance features is likely to propel the Banking System Software Market further, as organizations seek to avoid hefty fines and reputational damage.