Environmental Sustainability Goals

The Autonomous Trucks Market is also being driven by the growing emphasis on environmental sustainability. As nations strive to meet carbon reduction targets, the transportation sector is under pressure to adopt cleaner technologies. Autonomous trucks, particularly those powered by electric or alternative fuels, present a viable solution to reduce greenhouse gas emissions. Data suggests that transitioning to electric trucks could reduce emissions by up to 50% compared to traditional diesel vehicles. This alignment with sustainability goals is likely to attract investments and foster innovation within the Autonomous Trucks Market, as stakeholders seek to contribute to a greener future.

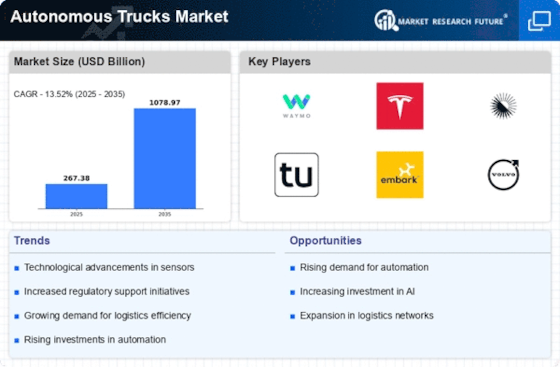

Rising Demand for Efficient Logistics

The Autonomous Trucks Market is experiencing a surge in demand for efficient logistics solutions. As e-commerce continues to expand, companies are seeking ways to optimize their supply chains. Autonomous trucks offer the potential for reduced operational costs and increased delivery speeds. According to recent data, logistics costs account for approximately 10-15% of total sales in many sectors. By integrating autonomous trucks, businesses may reduce these costs significantly, potentially leading to a 20% decrease in logistics expenses. This shift towards automation in logistics is likely to drive the growth of the Autonomous Trucks Market, as companies strive to remain competitive in a rapidly evolving marketplace.

Increasing Focus on Safety Regulations

Safety regulations are becoming increasingly stringent, influencing the Autonomous Trucks Market. Governments and regulatory bodies are emphasizing the need for enhanced safety measures in transportation. The introduction of regulations that mandate the use of advanced safety features in commercial vehicles is likely to drive the adoption of autonomous trucks. For example, the National Highway Traffic Safety Administration has proposed guidelines that could lead to the integration of autonomous technologies in freight transport. This regulatory push may create a favorable environment for the Autonomous Trucks Market, as companies seek to comply with new standards while improving operational safety.

Technological Innovations in Automation

Technological advancements play a crucial role in the growth of the Autonomous Trucks Market. Innovations in artificial intelligence, machine learning, and sensor technologies are enhancing the capabilities of autonomous vehicles. For instance, the development of advanced LIDAR systems and computer vision technologies enables trucks to navigate complex environments with greater precision. The market for autonomous vehicles is projected to reach USD 60 billion by 2030, indicating a robust growth trajectory. These technological innovations not only improve safety and efficiency but also contribute to the overall acceptance of autonomous trucks in various sectors, thereby propelling the market forward.

Labor Shortages in the Transportation Sector

Labor shortages are increasingly impacting the transportation sector, creating a significant driver for the Autonomous Trucks Market. The trucking industry faces a shortage of qualified drivers, with estimates indicating a shortfall of over 60,000 drivers in recent years. This shortage is prompting companies to explore automation as a solution to maintain operational efficiency. Autonomous trucks can potentially alleviate the pressure caused by labor shortages, allowing companies to continue meeting demand without relying solely on human drivers. As the industry adapts to these challenges, the Autonomous Trucks Market is likely to see accelerated growth as businesses invest in automated solutions.