Labor Shortages in Transportation

Labor shortages in the transportation sector are significantly impacting the autonomous trucks market. With an increasing number of truck drivers retiring and fewer individuals entering the profession, companies are facing challenges in meeting delivery demands. Autonomous trucks present a potential solution to this issue, allowing companies to maintain operations without relying solely on human drivers. The American Trucking Association has reported a shortage of over 80,000 drivers, which is expected to grow in the coming years. This shortage underscores the necessity for autonomous solutions, thereby driving growth in the autonomous trucks market.

Rising Demand for Freight Efficiency

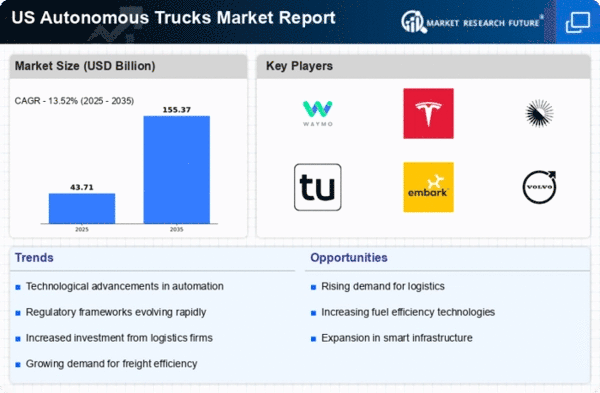

The autonomous trucks market is experiencing a surge in demand driven by the need for enhanced freight efficiency. Companies are increasingly seeking ways to optimize logistics and reduce operational costs. Autonomous trucks can operate continuously without the need for breaks, potentially increasing delivery speeds and reducing turnaround times. According to industry estimates, the adoption of autonomous trucks could lead to a reduction in freight costs by up to 30%. This efficiency is particularly appealing in the context of rising fuel prices and labor shortages, making the autonomous trucks market a viable solution for many logistics providers.

Consumer Demand for Faster Deliveries

Consumer expectations for faster deliveries are reshaping the logistics landscape, thereby impacting the autonomous trucks market. As e-commerce continues to grow, companies are under pressure to meet the demand for rapid shipping. Autonomous trucks can provide a solution by enabling 24/7 operations and reducing delivery times. Research indicates that 70% of consumers are willing to pay extra for same-day delivery, highlighting the importance of efficiency in logistics. This consumer demand is likely to drive companies to adopt autonomous trucks as a means to enhance their delivery capabilities and remain competitive in the market.

Increased Investment in Infrastructure

Investment in infrastructure is a crucial factor influencing the autonomous trucks market. As cities and states allocate funds for smart infrastructure projects, the integration of autonomous vehicles becomes more feasible. Enhanced roadways, dedicated lanes for autonomous trucks, and improved traffic management systems can facilitate the safe operation of these vehicles. The U.S. government has proposed significant funding for infrastructure improvements, which could exceed $1 trillion over the next decade. This investment not only supports the development of autonomous trucks but also encourages their adoption across various sectors, thereby expanding the market.

Technological Integration in Supply Chains

The integration of advanced technologies into supply chains is a key driver for the autonomous trucks market. Companies are leveraging artificial intelligence, machine learning, and IoT to enhance operational efficiency. The ability of autonomous trucks to communicate with other vehicles and infrastructure can lead to improved traffic management and reduced congestion. As of 2025, it is projected that the market for autonomous trucks will reach approximately $60 billion, reflecting the growing reliance on technology in logistics. This trend indicates a shift towards more automated and data-driven supply chain solutions, further propelling the autonomous trucks market.