Market Trends

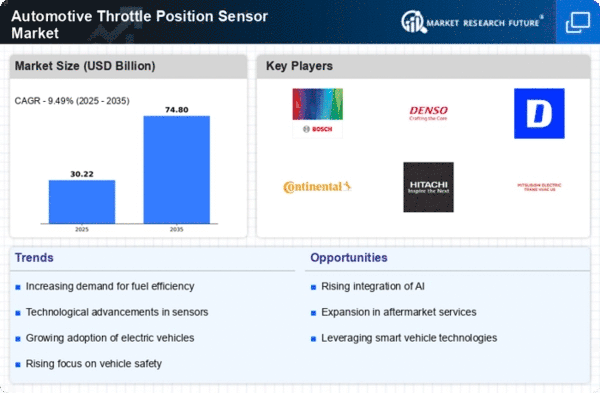

Key Emerging Trends in the Automotive Throttle Position Sensor Market

The fast-developing Automotive Throttle Position Sensor (TPS) Marketplace witnesses different tactics undertaken by such companies to sustain and capture the target market. Among the most important strategies is modern technology that aims at the development of more precise, effectively acting, and reliable TPS systems. Through combining with advanced sensor technologies and signal processing algorithms companies are able to stay ahead of the competition as they will be providing the automotive industry with unique, branded products differentiated by high-performing throttle position sensors, thus retaining their leadership in the market.

Cost leadership also is another widely used method by companies in order to gain some competitive advantage within Automotive TPS Market. Companies would be able to optimize the manufacturing processes, use materials efficiently, and realize economies of scale by which they can produce TPS solutions at a lower cost but without worsening the quality of the solutions. This cost-saving method helps businesses keep low prices so that their customers choose their products over others, and this contributes to higher customer base.

Strategic collaborations and partnerships assume a very important position in marketing concerning the Automotive TPS Market. Most businesses in this industry partner with OEMs, suppliers in other auto brands, or providers of technology to offer complete and integrated solutions. In addition to maximizing the value of TPS products, these alliances can significantly extend their distribution networks as well as potential clients. Such conjunctions enlarge the influence range and even act as a factor of control over the market.

The market segmentation is an existing approach which involves companies going a step further to tailor the TPS to the unique requirements of different vehicles, as for instance, passenger cars, trucks, or electric vehicles. By differentiating the vehicles by the type and size of engines, companies can cater to the distinctive needs of each segment successfully. Through this approach, the TPS provides tailored solutions adequately addressing a variety of automotive applications, hence making companies specialists in satisfying diverse customers’ needs.

The major strategy of the geographical expansion in the automotive TPS market is a vital strategy used by companies that aim to extend their market share. Companies can find expanding markets and venturing into previously unknown territories help them to cater to growing demand. Companies producing them can adapt their products’ specifications to local requirements such as emission standards and vehicle types, which allows them to be available in diverse markets, thus increasing their total market share which will be more adaptive.

Leave a Comment