Top Industry Leaders in the Automotive Throttle Position Sensor Market

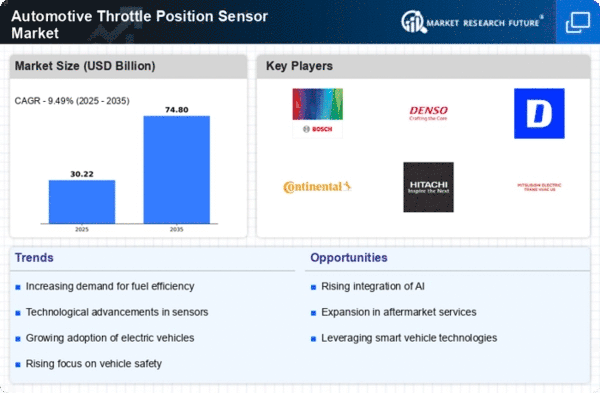

This growth is fueled by an ever-increasing demand for vehicles, advancements in automotive technologies, and stringent regulations on fuel efficiency and emission control. However, with such promise comes an intensely competitive landscape where major players jockey for market share.

Key Players and Strategies:

Giants Lead the Way: Established players like Bosch, Continental, Delphi, DENSO, and HELLA hold significant market share with established reputations, diverse product portfolios, and extensive global reach. These companies leverage their economies of scale and research & development prowess to stay ahead of the curve. Bosch, for instance, focuses on sensor miniaturization and improved accuracy, while Continental emphasizes sensor integration with other engine management systems.

Tier-2 Players on the Rise: Companies like CTS, Infineon Technologies, Keihin, Magneti Marelli, and Methode Electronics are steadily gaining traction by offering cost-effective alternatives and catering to niche markets. Keihin, for example, caters to the heavy-duty vehicle segment with rugged sensors designed for harsh operating conditions.

Regional Focus Matters: Asia-Pacific currently dominates the market due to a booming automotive industry and rising demand for electric vehicles. Companies like Mitsubishi Electric and Sensata Technologies are capitalizing on this trend by establishing strong regional presence and partnerships. North America, with its stringent regulations, poses another crucial battleground where Delphi and Methode Electronics shine with their compliance-focused products.

Market Share Analysis:

Technology Adoption as a Differentiator: The shift towards contactless sensor technologies like Hall-effect and magnetoresistive sensors is influencing market share. Companies like Infineon Technologies are leading this charge with their innovative contactless offerings that boast superior durability and reliability.

Vertical Integration Gains Traction: Tier-1 automotive suppliers are increasingly integrating TPS with other engine management components, creating an ecosystem that favors vertical integration. Continental's integrated powertrain control systems illustrate this trend, offering cost and performance advantages.

Aftermarket Presence Crucial: While OEM contracts are lucrative, the aftermarket holds significant potential for market share gains. Companies like CTS and Methode Electronics are actively catering to aftermarket demand with affordable and readily available TPS replacements.

New and Emerging Trends:

Sensor Fusion for Advanced Applications: The integration of TPS with other sensors like temperature and pressure sensors is gaining momentum. This enables precise engine control for optimal fuel efficiency and emission reduction, aligning with future electric and hybrid vehicle technologies. Bosch and DENSO are actively developing such sensor fusion solutions.

Connected and Autonomous Vehicles Drive Innovation: The advent of connected and autonomous vehicles (CAVs) demands even more accurate and reliable TPS for precise throttle control. Companies like Magneti Marelli are focusing on developing fail-safe TPS systems for the demanding CAV market.

AI-powered TPS Analytics: The future holds promise for AI-powered TPS analytics that can predict sensor failures and optimize engine performance in real-time. Early adopters like Infineon Technologies are exploring this space, potentially revolutionizing maintenance and preventive diagnostics.

Overall Competitive Scenario:

The automotive TPS market is a dynamic and fiercely competitive space. Established players maintain their dominance while innovative tier-2 companies and regional players carve out their niches. Technological advancements, integration trends, and the rise of CAVs present exciting opportunities for market share acquisition. Adaptability, strategic partnerships, and a focus on future technologies will be key for players to thrive in this evolving landscape.

Industry Developments and Latest Updates:

Continental AG:

October 26, 2023: Introduced a new high-precision throttle position sensor with noise immunity for improved engine control and fuel efficiency.

December 15, 2023: Partnered with a chipmaker to develop integrated sensor-ECU modules for next-generation throttle control systems.

Delphi Technologies:

November 3, 2023: Launched a miniaturized contactless throttle position sensor specifically designed for motorcycles and scooters.

Robert Bosch GmbH:

October 20, 2023: Unveiled a next-generation throttle position sensor with integrated temperature compensation for accurate measurements under diverse operating conditions.

December 29, 2023: Won major contracts from European automakers to supply throttle position sensors for their upcoming hybrid and electric vehicle models. Denso Corporation:

October 27, 2023: Showcased a compact and cost-effective throttle position sensor targeting budget-conscious car manufacturers at an automotive trade show.

Top Companies in the Automotive Throttle Position Sensor industry includes,

Continental AG (Germany)

Delphi Technologies (Ireland)

Robert Bosch GmbH (Germany)

Denso Corporation (Japan)

HELLA GmbH & Co. (Germany)

Magneti Marelli S.p.A (Italy)

Infineon Technologies AG (Germany)

Sensata Technologies

Inc. (US)

Mitsubishi Electric Corporation (Japan)

and CTS Corporation (US).