Focus on Sustainability

Sustainability has emerged as a pivotal driver within the Automotive Test Equipment Market. As manufacturers strive to meet stringent environmental regulations, there is a growing demand for testing equipment that can assess emissions and fuel efficiency accurately. The market is witnessing a surge in the development of eco-friendly testing solutions, which not only comply with regulations but also appeal to environmentally conscious consumers. Reports indicate that the market for emissions testing equipment alone is expected to reach several billion dollars by 2026. This focus on sustainability is reshaping the landscape of the automotive industry, compelling test equipment manufacturers to innovate and adapt their offerings accordingly.

Integration of Advanced Technologies

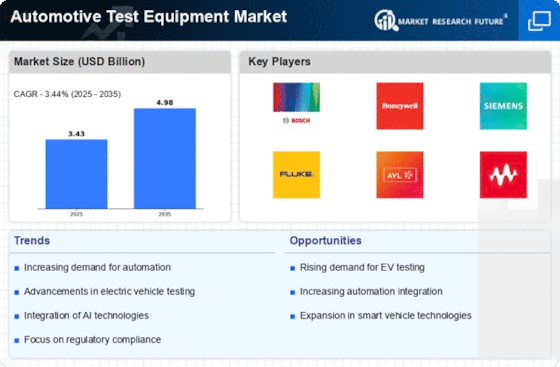

The Automotive Test Equipment Market is experiencing a notable shift due to the integration of advanced technologies such as artificial intelligence, machine learning, and IoT. These technologies enhance the testing processes, allowing for more accurate diagnostics and improved efficiency. For instance, AI-driven analytics can predict potential failures before they occur, thereby reducing downtime and maintenance costs. The market for automotive test equipment is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 6% in the coming years. This growth is largely attributed to the increasing complexity of automotive systems, necessitating sophisticated testing solutions that can keep pace with technological advancements.

Growing Demand for Vehicle Diagnostics

The growing demand for vehicle diagnostics is a significant driver in the Automotive Test Equipment Market. As vehicles become more technologically advanced, the complexity of diagnosing issues has increased, necessitating sophisticated testing equipment. This trend is particularly evident in the rise of onboard diagnostics systems, which require specialized tools for effective analysis. The market for diagnostic equipment is projected to grow at a robust pace, with estimates indicating a potential increase of over 5% annually. This demand is fueled by the need for timely and accurate diagnostics to enhance vehicle performance and customer satisfaction. Consequently, manufacturers are focusing on developing innovative diagnostic solutions to meet this rising demand.

Rise of Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles is significantly influencing the Automotive Test Equipment Market. As the automotive sector transitions towards electrification, there is an increasing need for specialized testing equipment that can evaluate battery performance, charging systems, and overall vehicle efficiency. Furthermore, the advent of autonomous driving technologies necessitates rigorous testing protocols to ensure safety and reliability. Market analysts project that the demand for automotive test equipment tailored for electric and autonomous vehicles will grow substantially, potentially accounting for a large share of the market by 2030. This trend underscores the necessity for manufacturers to invest in advanced testing solutions that cater to these emerging vehicle types.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are critical drivers in the Automotive Test Equipment Market. Governments worldwide are implementing stringent regulations to ensure vehicle safety and environmental protection. This has led to an increased demand for testing equipment that can verify compliance with these regulations. For instance, the need for crash testing equipment and emissions testing devices has surged as manufacturers seek to meet legal requirements. The market for automotive test equipment is expected to expand as companies invest in technologies that facilitate compliance with evolving standards. Analysts suggest that this trend will continue to shape the market landscape, driving innovation and investment in testing solutions.