Top Industry Leaders in the Automotive Structural Sheet Metal Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the Automotive Structural Sheet Metal industry are:

A&E Manufacturing Company (U.S.)

ATAS International Inc. (U.S.),

Associated Materials LLC (U.S.),

BlueScope Steel Limited (Australia),

ABC Sheet Metal (U.S.),

Noble Industries (U.S.),

United States Steel Corporation (U.S.),

Alcoa Inc.(U.S.),

Autoline Industries Ltd (India),

Bud Industries Inc. (U.S.),

Wise Alloys LLC(U.S.),

Prototek (India),

Nucor Corporation(U.S.),

General Sheet Metal Works Inc(U.S.).

NCI Building Systems Inc. (U.S.).

Bridging the Gap by Exploring the Competitive Landscape of the Automotive Structural Sheet Metal Top Players

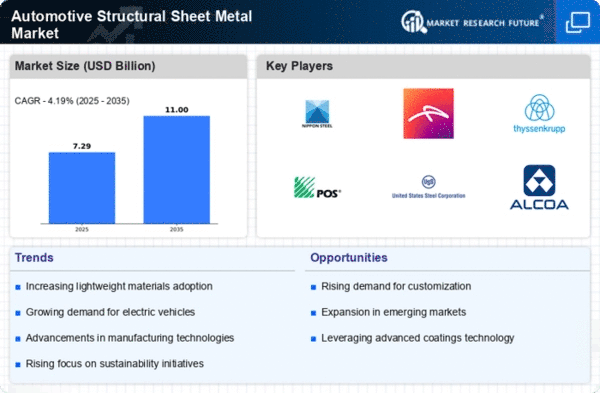

The automotive structural sheet metal market is a dynamic arena, fueled by the relentless pursuit of lightweight vehicles, stringent fuel efficiency regulations, and a burgeoning global automotive landscape. Within this market, a multitude of players vie for dominance, each employing diverse strategies and capitalizing on emerging trends to carve their niche.

Key Player Strategies:

Market Leaders: Established players like ArcelorMittal, POSCO, and Nippon Steel & Sumitomo Metal Corporation leverage their vast production capacities, extensive global networks, and established customer relationships to maintain their dominant positions. They heavily invest in research and development, focusing on advanced high-strength steels (AHSS) and lightweight aluminum alloys to cater to the evolving needs of automakers.

Regional Players: Regional players like Baoshan Iron & Steel Co. Ltd. (BSI) and Hyundai Steel capitalize on their geographical proximity to major automotive production hubs in Asia, offering cost-competitive solutions and flexible production capabilities. They actively collaborate with local automakers to develop customized sheet metal solutions for specific vehicle models.

Specialty Players: Niche players like SSAB and Nucor Corporation focus on specific product segments, such as high-performance steels and tailored blanks. They employ cutting-edge manufacturing processes and offer specialized services like laser cutting and surface treatments to cater to the demands of premium and performance-oriented vehicles.

Factors for Market Share Analysis:

Production Capacity and Geographical Reach: The ability to produce large volumes of sheet metal in strategic locations near automotive manufacturing hubs plays a crucial role in capturing market share. Players with well-established production networks and efficient logistics infrastructure hold a significant advantage.

Product Portfolio and Innovation: Offering a diverse range of sheet metal products, including AHSS, aluminum, and advanced composite materials, caters to the varied needs of automakers. Continuous investment in research and development to improve material properties and develop lighter, stronger solutions is key to staying ahead of the curve.

Cost Competitiveness and Price Flexibility: The ability to offer competitive pricing while maintaining quality standards is crucial in a cost-sensitive market. Players with efficient production processes, access to raw materials, and flexible pricing strategies gain an edge over competitors.

Customer Relationships and Brand Recognition: Building strong relationships with automakers through collaborative product development, technical support, and on-time deliveries fosters long-term partnerships and secures market share. Established brands with a reputation for quality and reliability have a natural advantage.

New and Emerging Trends:

Lightweighting: The relentless pursuit of fuel efficiency is driving the adoption of lightweight materials like AHSS and aluminum in car bodies. Players are developing new grades of sheet metal with enhanced strength-to-weight ratios to meet these demands.

Sustainability: The focus on reducing the environmental footprint of the automotive industry is leading to the adoption of recycled content and energy-efficient production processes in sheet metal manufacturing. Players are investing in closed-loop recycling systems and clean technologies to cater to this growing trend.

Advanced Manufacturing Techniques: The integration of Industry 4.0 technologies like automation, artificial intelligence, and data analytics is transforming sheet metal production. Players are investing in smart factories to optimize production processes, improve quality control, and reduce waste.

Overall Competitive Scenario:

The automotive structural sheet metal market is characterized by intense competition, with players constantly striving to differentiate themselves through innovative products, cost-effective solutions, and strong customer relationships. The market is expected to see continued growth driven by factors like increasing vehicle production, rising demand for lightweight materials, and stricter emission regulations. Players who can adapt to these evolving trends and implement strategic initiatives will be well-positioned to capture market share and secure long-term success.

Latest Company Updates:

ATAS International Inc. (U.S.)

- Launched a new line of advanced coated steel sheets for automotive applications (Source: ATAS International website, January 10, 2024).

Associated Materials LLC (U.S.)

- Collaborating with a research institute on developing new methods for recycling automotive scrap metal (Source: Associated Materials website, December 20, 2023).

ABC Sheet Metal (U.S.)

- Implementing new lean manufacturing practices to improve efficiency and reduce waste (Source: ABC Sheet Metal website, January 5, 2024).

Noble Industries (U.S.)

- Exploring new markets and applications for its automotive sheet metal products (Source: Noble Industries website, December 2023).