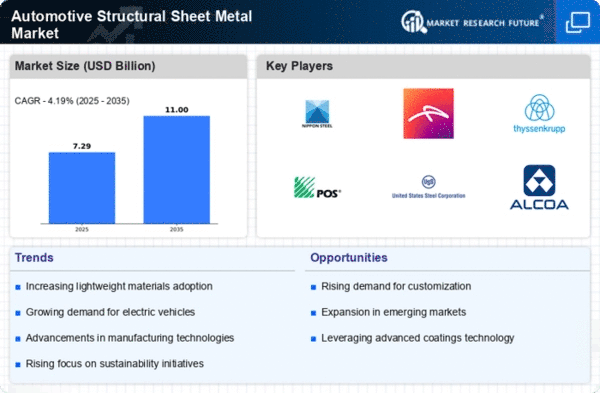

Market Share

Automotive Structural Sheet Metal Market Share Analysis

The automobile Structural Sheet Metal market is changing due to automobile design, material innovations, and production methods. Advanced high-strength steel and aluminum alloys for vehicle structural sheet metal are becoming more popular. To enhance fuel efficiency without compromising safety and structural integrity, automakers are emphasizing lightweight materials. This move toward lighter and tougher materials supports the industry's goal of lowering vehicle weight to fulfill strict emission rules and improve performance.

In automobile structural sheet metal components, tailor-welded and tailor-rolled blanks are becoming more popular. By welding sheets of varied thicknesses and strengths, tailor-welded blanks allow producers to optimize material utilization and customize qualities to specific component regions. Tailor-rolled blanks adjust sheet thickness for component portions. Innovative manufacturing methods boost vehicle safety, structural efficiency, and material waste reduction.

Hot stamping and hydroforming are being used more to make car structural sheet metal. Hot stamping makes strong, lightweight components by heating and shaping sheet metal in one process. Hydroforming shapes complicated, lightweight sheet metal structures with fluid pressure. These innovative forming methods optimize manufacturing and provide stronger, more complex vehicle components.

The Automotive Structural Sheet Metal industry is also seeing a rise in structural adhesives and bonding. Traditional welding is being supplemented with adhesive bonding to improve structural integrity, weight, and crash performance. Automakers can build more complicated and lightweight structures with structural adhesives, improving vehicle economy and safety. This trend follows the industry's focus on new joining methods to overcome lightweight material constraints.

Automotive Structural Sheet Metal is seeing demand for creative structural designs to meet new engine architectures and safety concerns in electric and driverless vehicles. To handle battery integration and vehicle weight distribution, EVs need strong structural sheet metal components. Designing buildings to support changing automotive technology shows the industry's flexibility to vehicle propulsion and autonomy.

Automotive manufacturers' sustainability and recycling efforts also affect the market. Environmentally responsible automakers use recycled and recyclable structural sheet metal components. This trend supports the car industry's desire to reduce its environmental effect and adopt sustainable production.

In conclusion, the Automotive Structural Sheet Metal market is characterized by trends like the use of advanced materials like AHSS and aluminum alloys, tailor-welded and tailor-rolled blanks, advanced forming technologies, structural adhesives, EV and autonomous vehicle design, and sustainability and recycling. These trends demonstrate the industry's dedication to innovation, efficiency, safety, and sustainability. To fulfill automakers' changing needs and build lightweight, robust, and sustainable automobile structures, automobile Structural Sheet Metal companies must negotiate these changes."

Leave a Comment