Growing Focus on Safety Regulations

The Automotive Seat Market is significantly influenced by the stringent safety regulations imposed by various governments. These regulations mandate the incorporation of advanced safety features in vehicle seating, such as side airbags and enhanced crash protection systems. As a result, manufacturers are compelled to innovate and improve their seat designs to comply with these regulations. The market data suggests that the demand for seats equipped with advanced safety features is expected to increase, driven by consumer awareness and regulatory pressures. This focus on safety not only enhances the appeal of vehicles but also positions manufacturers favorably within the competitive landscape of the Automotive Seat Market.

Rising Demand for Electric Vehicles

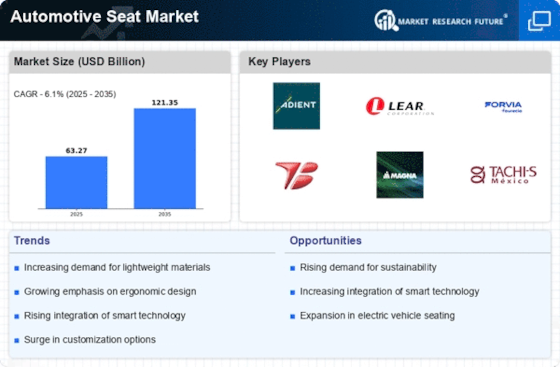

The increasing adoption of electric vehicles (EVs) is a pivotal driver for the Automotive Seat Market. As consumers become more environmentally conscious, the demand for EVs is projected to rise significantly. According to recent data, the EV market is expected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. This surge in EV production necessitates the development of specialized seating solutions that cater to the unique requirements of electric vehicles, such as lightweight materials and innovative designs. Consequently, manufacturers in the Automotive Seat Market are likely to invest in research and development to create seats that enhance comfort and safety while aligning with the sustainability goals of EV manufacturers.

Shift Towards Lightweight Materials

The Automotive Seat Market is witnessing a notable shift towards the use of lightweight materials in seat manufacturing. This trend is primarily driven by the need for improved fuel efficiency and reduced emissions in vehicles. Manufacturers are increasingly adopting materials such as advanced composites and high-strength steel to create lighter seats without compromising safety or comfort. Data suggests that the use of lightweight materials in automotive seating could lead to a reduction in vehicle weight by up to 10%, which is significant for fuel economy. As a result, this shift is likely to influence design strategies and material selection in the Automotive Seat Market, fostering innovation and sustainability.

Increase in Vehicle Production and Sales

The Automotive Seat Market is experiencing growth due to the rising production and sales of vehicles across various segments. As economies recover and consumer confidence improves, vehicle sales are projected to rise steadily. Recent statistics indicate that global vehicle production is expected to reach over 100 million units annually by 2026. This increase in production directly correlates with a heightened demand for automotive seats, as each vehicle requires multiple seating solutions. Consequently, manufacturers in the Automotive Seat Market are likely to ramp up production capabilities to meet this growing demand, thereby driving innovation and competition within the sector.

Technological Advancements in Seat Design

Technological innovations are transforming the Automotive Seat Market, leading to the development of advanced seating solutions. Features such as integrated heating and cooling systems, adjustable lumbar support, and memory foam technology are becoming increasingly prevalent. The market for smart seats, which can monitor driver posture and provide feedback, is also gaining traction. Data indicates that the market for smart automotive seats is expected to grow at a CAGR of approximately 15% over the next five years. These advancements not only enhance passenger comfort but also contribute to overall vehicle safety, making them a crucial focus for manufacturers in the Automotive Seat Market.