Growth of Electric and Hybrid Vehicles

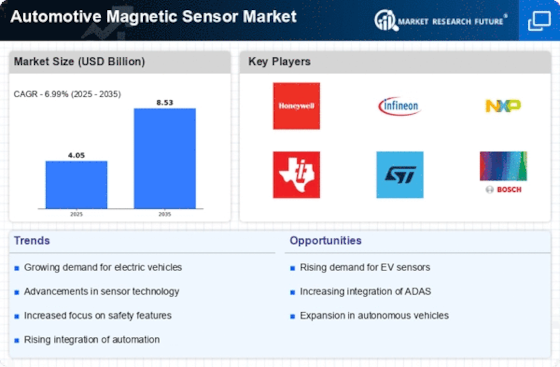

The Automotive Magnetic Sensor Market is poised for growth due to the increasing adoption of electric and hybrid vehicles. These vehicles utilize magnetic sensors for various applications, including battery management systems, motor control, and position sensing. As the automotive industry shifts towards electrification, the demand for efficient and reliable sensors is likely to rise. Market analysts suggest that the electric vehicle segment could witness a compound annual growth rate (CAGR) of over 20% in the coming years. This transition not only enhances the performance of electric vehicles but also drives innovation in sensor technology, thereby bolstering the Automotive Magnetic Sensor Market. The emphasis on sustainability and reduced emissions further propels this trend, making it a pivotal driver for market expansion.

Regulatory Compliance and Safety Standards

The Automotive Magnetic Sensor Market is also influenced by stringent regulatory compliance and safety standards imposed by governments worldwide. As safety regulations become more rigorous, automotive manufacturers are compelled to incorporate advanced sensor technologies to ensure compliance. Magnetic sensors are critical in meeting these safety standards, particularly in applications related to collision avoidance and stability control. The increasing emphasis on vehicle safety is likely to drive demand for high-quality magnetic sensors, as manufacturers seek to enhance their product offerings. Market forecasts suggest that the regulatory landscape will continue to evolve, further propelling the growth of the Automotive Magnetic Sensor Market as companies adapt to meet these challenges.

Increasing Focus on Vehicle Electrification

The Automotive Magnetic Sensor Market is significantly impacted by the increasing focus on vehicle electrification. As manufacturers strive to meet stringent emissions regulations and consumer demand for eco-friendly vehicles, the integration of magnetic sensors in electric and hybrid vehicles becomes essential. These sensors are integral to various systems, including energy management and regenerative braking. The electrification trend is expected to drive substantial growth in the automotive sensor market, with projections indicating a potential increase in market size by several billion dollars over the next few years. This shift not only enhances vehicle efficiency but also positions the Automotive Magnetic Sensor Market as a key player in the transition towards sustainable transportation solutions.

Technological Advancements in Sensor Technology

Technological advancements are significantly influencing the Automotive Magnetic Sensor Market. Innovations in sensor design, materials, and manufacturing processes are enhancing the performance and reliability of magnetic sensors. For instance, the development of miniaturized sensors with improved sensitivity and accuracy is enabling their integration into a wider range of automotive applications. Furthermore, advancements in wireless technology are facilitating the deployment of contactless magnetic sensors, which are increasingly favored in modern vehicles. As automotive manufacturers seek to improve vehicle performance and efficiency, the demand for cutting-edge sensor technology is expected to rise. This trend indicates a promising outlook for the Automotive Magnetic Sensor Market, as it adapts to the evolving needs of the automotive sector.

Rising Demand for Advanced Driver Assistance Systems

The Automotive Magnetic Sensor Market is experiencing a notable surge in demand for advanced driver assistance systems (ADAS). These systems, which enhance vehicle safety and driving experience, rely heavily on precise sensor technology. Magnetic sensors play a crucial role in applications such as lane departure warning, adaptive cruise control, and parking assistance. As automotive manufacturers increasingly prioritize safety features, the market for magnetic sensors is projected to grow significantly. According to recent estimates, the ADAS segment is expected to account for a substantial portion of the automotive sensor market, potentially reaching a valuation of several billion dollars by 2026. This trend indicates a robust growth trajectory for the Automotive Magnetic Sensor Market, driven by the integration of sophisticated safety technologies.