Top Industry Leaders in the Automotive Lubricants Market

Automotive lubricants Market

These intricate concoctions, composed of base oils, additives, and viscosity modifiers, keep automotive hearts beating smoothly and efficiently. But navigating this dynamic orchestra requires a discerning ear to the strategies, players, and recent developments shaping the market.

Market Titans and their Oiled Playbooks:

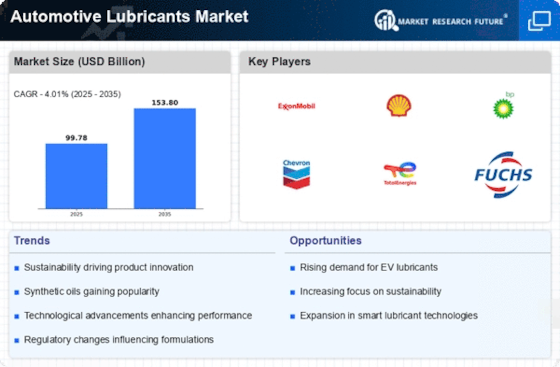

Several established manufacturers like ExxonMobil, Shell, BP, TotalEnergies, and Chevron vie for top billing in this lubrication opera, each employing unique strategies to grease the competition:

-

Product Portfolio Diversification: Beyond traditional mineral oils, companies are expanding their offerings to include synthetic and semi-synthetic lubricants cater to the diverse needs of modern engines, electric vehicles, and hybrid powertrains. Shell, for instance, boasts a diverse portfolio catering to high-performance, fuel-efficient, and environmentally friendly needs. -

Geographic Expansion: Emerging markets in Asia-Pacific, particularly China and India, present immense growth potential. Established players are setting up blending plants and distribution networks in these regions to capitalize on this burgeoning demand. ExxonMobil has a strong presence in China and Southeast Asia. -

Technological Innovation: Continuous R&D efforts focus on developing next-generation lubricants with enhanced wear protection, friction reduction, and extended oil drain intervals. This includes exploring graphene-based additives and nanotechnology solutions. BP has pioneered developments in low-viscosity lubricants for improved fuel efficiency. -

Sustainability Focus: Environmental concerns are driving the development of bio-based lubricants derived from renewable resources like vegetable oils and recycled materials. TotalEnergies emphasizes sustainable practices throughout its lubricant formulation and production processes. -

Strategic Partnerships and Acquisitions: Collaborations with research institutions, universities, and automotive manufacturers foster innovation and facilitate access to new technologies and markets. Acquisitions of smaller companies with specialized expertise also help consolidate market share. Chevron recently acquired a leading manufacturer of electric vehicle lubricants.

Factors Determining Market Share: Beyond the Viscosity Grade:

Beyond brand recognition, several factors determine a company's success in the automotive lubricants market:

-

Lubricant Performance: Superior wear protection, friction reduction, fuel efficiency, and thermal stability are crucial for customer satisfaction and brand loyalty. -

Vehicle Compatibility: Offering lubricants tailored to specific car models, engine types, and operating conditions is essential for optimal performance. -

Pricing and Cost Competitiveness: Offering competitive pricing while maintaining quality is essential, especially in price-sensitive segments like aftermarket lubricants. -

Technical Expertise and Support: Providing comprehensive technical guidance and application know-how helps customers choose the right lubricant for their vehicles. -

Compliance with Regulations: Navigating the complex web of regulations governing lubricant composition, labeling, and disposal is critical for market compliance.

Key Players:

- ROCOL (UK)

- American Synthol, Inc. (US)

- Gulf Oil (India)

- LIQUI MOLY GmbH (Germany)

- Ashland Inc. (US)

- Total (France)

- PT Pertamina (Persero) (Indonesia)

- Royal Dutch Shell PLC (Netherlands)

- IDEMITSU Kosan Co., Ltd. (Japan)

- LUKOIL (Russia)

- BP PLC (UK)

- ConocoPhillips Corporation (US)

- Fuchs (US)

- Chevron Corporation (US)

- ExxonMobil Corporation (US)

Recent Developments in the Lubrication Symphony:

December 2023: ExxonMobil develops a novel self-healing lubricant technology that automatically repairs micro-scratches in engine components, extending engine life and reducing maintenance costs.

November 2023: BP partners with a tech startup to develop smart lubricants integrated with sensors for real-time engine health monitoring and predictive maintenance.

October 2023: TotalEnergies successfully scales up production of its bio-based lubricant line made from recycled vegetable oils, offering a sustainable alternative to traditional lubricants.

September 2023: A consortium of major lubricant manufacturers launches a research project to explore the potential of using artificial intelligence in lubricant formulation for optimal performance and efficiency.