Increasing Vehicle Ownership

The rise in vehicle ownership is a pivotal driver for the Automotive Lubricants Aftermarket. Industry. As more individuals acquire vehicles, the demand for maintenance products, including lubricants, escalates. In recent years, the number of registered vehicles has surged, with estimates indicating that there are over 1.4 billion vehicles on the roads. This growing vehicle population necessitates regular maintenance, thereby propelling the demand for automotive lubricants. Furthermore, as vehicles age, the need for high-quality lubricants becomes even more pronounced, as older engines require more frequent oil changes and specialized products to maintain performance. Consequently, the Automotive Lubricants Aftermarket Industry is likely to experience sustained growth as vehicle ownership continues to rise.

Expansion of Automotive Service Centers

The proliferation of automotive service centers significantly influences the Automotive Lubricants Aftermarket. Industry. As the number of service centers increases, so does the accessibility of lubricant products for consumers. This trend is particularly evident in urban areas, where convenience plays a crucial role in consumer choices. Service centers often offer a range of lubricants, catering to diverse vehicle types and customer preferences. Moreover, the expansion of quick-service oil change facilities has further stimulated the market, as these establishments typically promote regular oil changes and the use of high-quality lubricants. This accessibility and promotion of lubricants at service centers are likely to enhance the overall growth of the Automotive Lubricants Aftermarket Industry.

Rising Awareness of Vehicle Maintenance

There is a growing awareness among vehicle owners regarding the importance of regular maintenance, which serves as a significant driver for the Automotive Lubricants Aftermarket. Industry. Educational campaigns and increased access to information have led consumers to understand the critical role that lubricants play in vehicle performance and longevity. This heightened awareness has resulted in more frequent oil changes and the use of premium lubricants, as consumers seek to protect their investments. Data suggests that regular maintenance can extend vehicle life by up to 30 percent, further motivating owners to invest in quality lubricants. As this trend continues, the Automotive Lubricants Aftermarket Industry is poised for growth, driven by informed consumer choices.

Technological Innovations in Lubricants

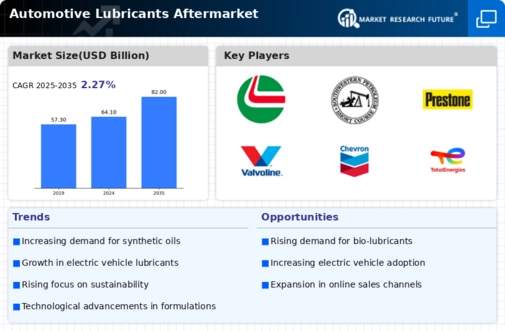

Technological advancements in lubricant formulations are reshaping the Automotive Lubricants Aftermarket. Industry. Innovations such as the development of synthetic and high-performance lubricants have enhanced engine efficiency and longevity. These advancements not only improve vehicle performance but also cater to the evolving needs of modern engines, which often require specialized lubricants. The introduction of advanced additives and improved viscosity characteristics has led to a surge in demand for these innovative products. As manufacturers continue to invest in research and development, the Automotive Lubricants Aftermarket Industry is likely to benefit from the introduction of new and improved lubricant options that meet the stringent requirements of contemporary vehicles.

Regulatory Changes and Environmental Standards

Regulatory changes and increasing environmental standards are becoming increasingly influential in the Automotive Lubricants Aftermarket. Industry. Governments worldwide are implementing stricter regulations regarding emissions and environmental impact, prompting manufacturers to develop eco-friendly lubricants. This shift towards sustainable products is not only a response to regulatory pressures but also aligns with consumer preferences for environmentally responsible options. The market for bio-based and biodegradable lubricants is expanding, as consumers and businesses alike seek to reduce their ecological footprint. As these regulations evolve, the Automotive Lubricants Aftermarket Industry is expected to adapt, leading to a greater emphasis on sustainable lubricant solutions.

Leave a Comment