Top Industry Leaders in the Automotive Intelligence Battery Sensor Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Automotive Intelligence Battery Sensor industry are:

Continental AG (Germany),

Robert Bosch GmbH (Germany),

HELLA GmbH and Co. KGaA (Germany),

Inomatic GmbH (Germany)

NXP Semiconductors (Netherlands),

ams AG (Austria),

Furukawa electric co., ltd. (Japan),

Vishay Intertechnology Inc. (U.S.),

DENSO CORPORATION (Japan),

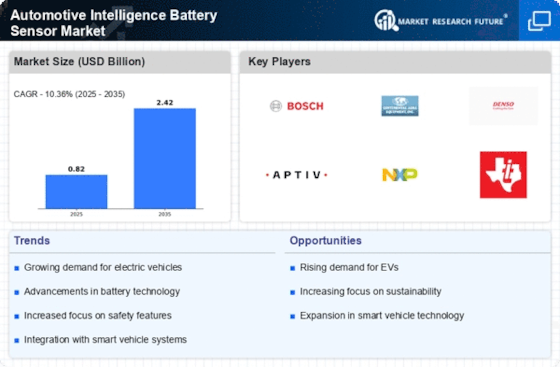

Competitive Landscape of the Automotive Intelligence Battery Sensor Market: Strategies, Trends, and Players

The burgeoning adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) has ignited the fire within the automotive intelligence battery sensor (AIBS) market. These sensors provide real-time data on battery health, charge levels, and performance, critical for optimal vehicle operation and extended battery life. This dynamic market landscape is characterized by intense competition, each player vying for a larger slice of the pie.

Key Player Strategies:

Established players: Automotive giants like Bosch, Continental, and Denso leverage their deep industry knowledge and existing manufacturing infrastructure to offer comprehensive AIBS solutions, often integrated with broader onboard diagnostics systems. Their focus lies on reliability, scalability, and cost-effectiveness for mass production.

Technology startups: Nimble and innovative, companies like Sensority and Battrion capitalize on cutting-edge sensor technologies and data analytics platforms. They offer highly sophisticated AIBS with advanced features like predictive maintenance and remote monitoring, targeting premium and high-performance segments.

Tier 1 suppliers: Companies like Delphi and Magna International bridge the gap between established players and startups. They focus on specific components like current sensors or temperature probes, collaborating with both OEMs and sensor developers to cater to diverse market needs.

Factors for Market Share Analysis:

Technology portfolio: The range and sophistication of sensors offered, including current, voltage, temperature, and impedance monitoring capabilities, directly influence market share. Companies with advanced data processing and communication protocols stand out.

Compatibility and integration: Seamless integration with existing vehicle electrical systems and compatibility with diverse battery types are crucial. Players offering plug-and-play solutions with minimal customization requirements gain an edge.

Cost and performance: Finding the right balance between sensor performance, functionality, and cost is critical for market penetration. Offering cost-effective yet reliable solutions is key to capturing budget-conscious segments.

Brand reputation and partnerships: Established brands and strategic partnerships with OEMs or battery manufacturers lend credibility and market access. Companies actively involved in industry collaborations gain advantages.

New and Emerging Trends:

AI-powered battery management systems: Integrating AI algorithms into AIBS allows for predictive maintenance, early fault detection, and optimized charging strategies, further enhancing battery life and performance.

Cloud connectivity and remote monitoring: Real-time battery data transfer to cloud platforms enables remote monitoring by fleet managers and service providers, optimizing vehicle maintenance schedules and improving operational efficiency.

Cybersecurity and data privacy: With more data being collected and transmitted, robust cybersecurity measures and data privacy protocols become crucial to gaining customer trust and preventing unauthorized access.

Sustainability and ethical sourcing: Manufacturers are increasingly focusing on using recycled materials and implementing sustainable production processes for AIBS components, addressing growing environmental concerns.

Overall Competitive Scenario:

The AIBS market is characterized by fierce competition, with players constantly innovating to differentiate themselves. While established giants hold a market share advantage, startups with disruptive technologies and niche solutions are making their mark. Collaboration and partnerships are becoming increasingly common as companies pool resources and expertise to create comprehensive AIBS solutions for the rapidly evolving EV and HEV landscape. The focus on advanced features, cost-effectiveness, and sustainability will shape the future of this dynamic market, with players actively adapting their strategies to stay ahead of the curve.

Latest Company Updates:

Continental AG (Germany):

- October 26, 2023: Announced collaboration with Ennovate Technology for high-precision battery cell sensors to optimize EV performance and range. (Source: Continental press release)

Robert Bosch GmbH (Germany):

- December 12, 2023: Partnered with Contemporary Amperex Technology Co., Ltd. (CATL) to develop and manufacture battery management systems with advanced cell voltage monitoring. (Source: Bosch press release)

HELLA GmbH and Co. KGaA (Germany):

- November 8, 2023: Acquired battery sensor technology company eSense to strengthen its EV components portfolio. (Source: HELLA press release)

NXP Semiconductors (Netherlands):

- December 15, 2023: Introduced a new family of battery management system ICs with integrated safety features and advanced analytics capabilities. (Source: NXP press release)

ams AG (Austria):

- November 17, 2023: Launched a high-resolution pressure sensor specifically designed for monitoring liquid cooling systems in EV batteries. (Source: ams press release)