BlackBerry

January 6, 2025: QNX, a division of BlackBerry Limited, announced a collaboration with Microsoft to facilitate the development of Software-Defined Vehicles (SDVs). This partnership will make the QNX® Software Development Platform (SDP) 8.0 available on Microsoft Azure, providing a cloud environment for developers to create, test, and integrate software for next-generation automotive applications.

Future plans include extending the solution to incorporate the QNX® Hypervisor and the new QNX® Cabin, a reference architecture enabling OEMs to develop hardware-agnostic digital cockpits using the cloud.

January, 2025: At CES 2025, QNX showcased its latest advancements in automotive technology. Highlights included the relaunch of the QNX brand, the introduction of "QNX Everywhere" to empower developers, the unveiling of QNX Cabin to simplify digital cockpit development, and a collaboration with Microsoft to accelerate SDV development.

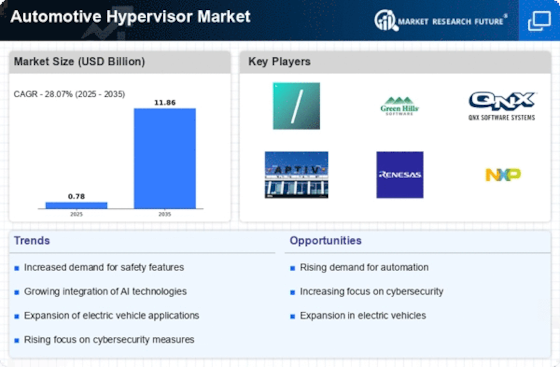

Continental AG: May 2024: The company revealed a partnership with several OEMs to implement their hypervisor technology in upcoming electric vehicle models, focusing on advanced driver-assistance systems (ADAS) and Continental AG showcased its hypervisor solutions at the Automotive Electronics Conference, highlighting key features such as improved real-time processing and enhanced cybersecurity measures.

NXP Semiconductor NV: June 2024: The company revealed a collaboration with Continental AG to integrate their hypervisor technologies, aiming to streamline the development of next-gen automotive applications and NXP participated in the Global Automotive Hypervisor Market Summit, where they presented their latest advancements in hypervisor technology, focusing on scalability and performance in connected vehicles. January 2024: Stellantis N.V. has developed the world’s first virtual cockpit platform, significantly accelerating infotainment delivery—up to 100 times faster. Using BlackBerry’s QNX Hypervisor in the cloud, accessible via AWS Marketplace, the platform replicates vehicle controls virtually without altering core software, reducing development time from months to under 24 hours.

December 2020, Renesas Electronics Corporation will launch the R-Car V3U, an ASIL D System-on-Chip (SoC) for autonomous driving (AD) systems. As a result, it offers 60 TOPS with low power consumption for deep learning computation. The R-Car V3U is intended to meet the ADAS and AD performance, safety, and scalability criteria for the next generation of autonomous vehicles.

In April 2024, BlackBerry Limited announced the partnership with ETAS GmbH for the sale and marketing of software solutions that will enhance the safety features available within the next-generation software-defined vehicles. This partnership is focused on the European Region.

In January 2024, Panasonic Holdings Corporation announced the development of a new system that improves the high-performance computing system by creating a single pod of multiple CUs that performs the care features such as driving and entertainment functions.

In January 2023, Panasonic Automotive Systems Co., Ltd. reported the completion and revision of the Partnership for Vehicle Cybersecurity (PVC), which seeks to develop next-generation vehicle cockpit systems that can defend against cyberattacks. According to the trend of integrating meters and infotainment systems into a hypervisor-based*1 virtualization platform, next-generation cockpit systems tend to consolidate several electronic control units (ECUs) into a single ECU.

In January 2024, Panasonic Automotive Systems announced its ts High-Performance Compute (HPC) system. Named Neuron, this is an automotive technology innovation designed to respond to the trends in mobility requirements for the development of a software-defined vehicle. With this, Panasonic Automotive would be able to perform not only software version upgrades and updates but also hardware platform changes throughout the lifecycle of the platform.

During the November conference of 2023, Panasonic claimed to have introduced a virtual skip gen on AWS, which would shift the Automotive Development Lifecycle to the left. This means engineers and developers would have the ability to start working on it without needing any physical hardware. The virtual skip currently in possession of Panasonic is their 3rd generation Digital Cockpit solution, and it was created in partnership with Amazon. This is aimed at revolutionizing the cockpit market.