Top Industry Leaders in the Automotive Hypervisor Market

*Disclaimer: List of key companies in no particular order

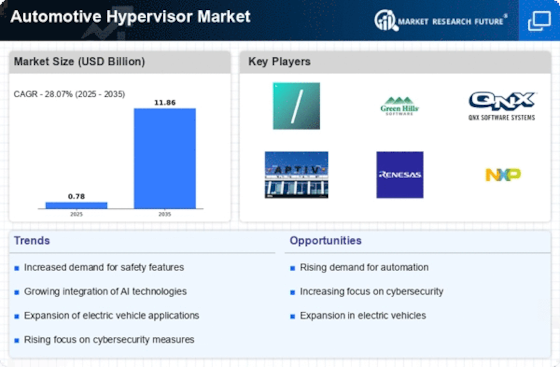

The automotive hypervisor market is currently undergoing a remarkable transformation driven by the soaring demand for advanced driver-assistance systems (ADAS) and the expanding autonomous driving (AD) landscape. Central to this transformative journey is the hypervisor, a software orchestrator that effectively manages the complex interplay of operating systems within vehicles. The competition within this domain is fierce, as established entities engage in a heated battle against agile startups, each striving for a prominent position in this evolving market.

Key Player Strategies: Market players such as Continental AG, NXP Semiconductor NV, Renesas Electronics Corporation, Green Hills Software LLC, Blackberry, IBM, Saskan Technologies Limited, Mentor Graphics Corporation, Infineon Technologies AG, Sysgo AG, and others shape the landscape.

Established Titans: Leading entities like Wind River Systems, Green Hills Software, and NXP Semiconductors wield their extensive experience and industry connections to secure major deals with top automakers. Wind River boasts partnerships with BMW and Toyota, while Green Hills powers Ford's ADAS systems. Their focus remains on robust security, reliability, and real-time performance, crucial for safety-sensitive AD applications.

Technology Challengers: Companies like Hyperion Systems, Elektreai, and Acmetec strive to disrupt the market with innovative hypervisor solutions tailored for specific requirements. Hyperion Systems specializes in virtualizing heterogeneous hardware platforms, a critical capability for integrating legacy systems with cutting-edge ADAS features. Agility, scalability, and cost-effectiveness are their primary selling points.

Tier 1 Suppliers: Automotive giants Continental, Bosch, and ZF Group are developing their hypervisors to gain control over the software stack and differentiate their offerings. Continental's Autosar Classic Platform 4.5 targets standardization and reduced ECU complexity, while Bosch focuses on open-source solutions like Automotive Grade Linux (AGL) for enhanced flexibility and collaboration.

Market Share Analysis:

-

Type: The Type 1 hypervisor segment, providing bare-metal control and real-time performance, currently dominates the market due to its suitability for safety-critical AD functions. However, the Type 2 hypervisor segment is expected to gain traction for less demanding infotainment and connectivity applications. -

Vehicle Class: Premium and luxury vehicles, packed with advanced features, are early adopters of hypervisors. However, mid-range and budget segments are poised for significant growth as ADAS features trickle down. -

Regional Focus: North America leads the market, driven by strong automotive innovation and early ADAS adoption. Nevertheless, Asia-Pacific is positioned for explosive growth due to its burgeoning car market and government initiatives promoting connected and autonomous vehicles.

New and Emerging Trends:

-

Virtualization of AD Functions: With increasing AD complexity, virtualizing AD functions using hypervisors will enhance safety and facilitate independent software updates. -

Cloud-Connected Hypervisors: Hypervisors with cloud connectivity enable real-time data exchange for over-the-air (OTA) updates, predictive maintenance, and remote diagnostics. -

Hypervisor Security: Secure hypervisors with robust hardware-based isolation and intrusion detection capabilities are becoming indispensable amid rising cyber threats. -

Open-Source Hypervisors: AGL is gaining traction, fostering collaboration and faster innovation within the ecosystem.

Overall Competitive Scenario: The automotive hypervisor market is a dynamic landscape marked by intense competition, rapid technological advancements, and evolving customer needs. Established players maintain strong positions but face challenges from innovative startups and Tier 1 suppliers. Success will hinge on adaptability, specialization, and the ability to cater to diverse customer requirements across different segments and regions. Open-source collaboration, security, and cloud integration are likely to be key differentiators in the years to come.

As the race towards autonomous driving intensifies, the automotive hypervisor remains a critical puzzle piece. This market holds immense potential for players who can navigate the competitive landscape with strategic brilliance and technological prowess.

Industry Developments and Latest Updates:

Continental AG:

- Announced the launch of its Hypervisor 2.0, designed for high-performance and safe vehicle architectures, enabling the consolidation of multiple ECUs onto a single hardware platform, thereby reducing complexity and cost.

NXP Semiconductor NV:

- Unveiled its Virtualization Platform 4.0, featuring a hypervisor optimized for automotive SoCs, offering improved security, real-time performance, and compliance with the latest ISO 26262 standards.

Renesas Electronics Corporation:

- Showcased its R-Car hypervisor solution, highlighting its scalability and compatibility with various R-Car SoCs, supporting mixed-criticality systems and enabling secure resource partitioning.

Green Hills Software LLC:

- Received ASIL D system-level certification for the Integrity Multivisor, proving its suitability for safety-critical automotive applications.

Blackberry:

- Announced the availability of QNX OS version 7.2 with enhanced hypervisor capabilities, focusing on improved virtual machine management, security features, and integration with QNX OS tools.