July 2024: The world economy's backbone is the commercial vehicle industry. Commercial vehicles handle 80% of all overland transportation. An average of 150,000 kilometers are driven by each truck annually to maintain the economy's flow of goods.

By 2035, fuel cell and fully electric trucks with batteries are expected to make up about 30% of the world's truck production. This implies that for the foreseeable future, internal combustion engines will continue to be a necessary form of propulsion everywhere. On short-haul routes, battery-electric drive systems will primarily be utilized in the medium- and heavy-duty truck segments. Long-term benefits are realized by fuel cells and combustion engines that run on hydrogen or other renewable fuels.

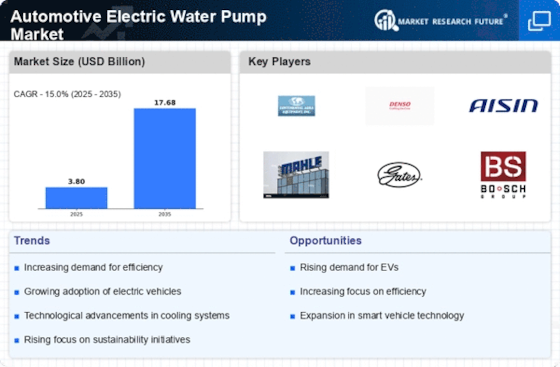

Hence, MAHLE represents technological diversity and creates the best solutions for any use case globally through its three strategic areas of electrification, thermal management, and highly efficient sustainable combustion engines. The company helps to lessen the carbon footprint of road freight transportation in this way.

February 2023: Motion & Control Enterprises finalized the acquisition of Precision Pump & Valve, a respected distributor with expertise in safety relief and control valves, pumps, and related equipment. Precision Pump & Valve is well-known for delivering customized solutions to the oil and gas, petrochemical, and chemical processing sectors.

In February 2023, Schaeffler Technologies AG & Co. KG, under its sub-brand INA, introduced a range of electric auxiliary water pumps. These pumps are designed to meet OEM requirements with a wide scope for the European market. The Auxiliary water pumps are essential for after-run, fuel systems, turbocharger cooling, high-voltage battery and inverter cooling in electric and hybrid vehicles. Besides, they are also crucial for cooling the high voltage battery and inverter in electric and hybrid vehicles.

In September 2023, NTN Corporation, a supplier of automotive parts, announced the expansion of their line of products to include a range of auxiliary electric water pumps. This product line features over 40 models that fulfill the heightening need for advanced coolant pumps for electric and hybrid vehicles. Powered by innovative PPS plastic bearing technology, these pumps are designed to reduce CO2 emissions while saving energy due to lower friction by over 30%.

Gates Corporation, one of the leaders in the global markets in manufacturing fluid power and other specific applications, introduced the ThermalPro electric water pumps that are directed toward electric vehicles (EVs) in November 2021. This next-generation technical advance's most important attribute is its unparalleled tuned construction that allows overload ranges from 100 watts to 3 kilowatts (4.0 hp).

In September 2021, an International automotive manufacturer placed an order with Rheinmetall Automotive AG for CWA400 electric coolant pumps that shipped in September 2021. The coolant pumps are intended for luxury hybrid automobiles with 2.5-liter four-cylinder engines, and the completion date for delivery is set by the year 2024.

An electric coolant pump supplier, Bosch, announced in August 2022 they will be expanding their electric pump portfolio for the aftermarket area. These pumps are capable of thermal management of automobiles that are hybrids and electric only. As of 2022, the company offered workshop customers 50 article numbers as part of their order, including 14 variants for hybrid and electric vehicles.