Market Trends

Key Emerging Trends in the Automotive Diagnostic Scan Tools Market

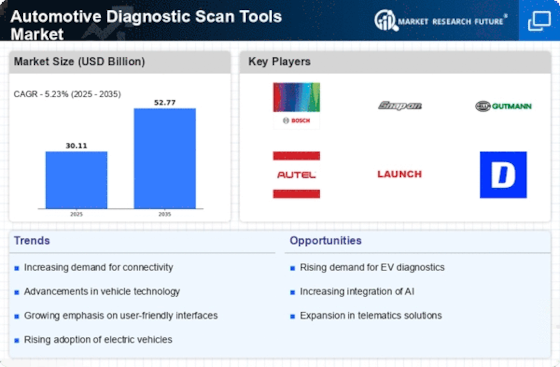

It is expected that the amount of the Automotive Diagnostic Scan Tools industry will be from 28.41 billion in 2023 to 45.28 billion during the period of 2023 to 2032 at the annual growth rate 6%. Rising awareness regarding vehicle safety, the fact that there are more towns or cities that are growing in numbers, and the rapidly growing the after-sale services industry are the factors driving the market that have a positive impact on the market growth.Arguably, positioning strategies are among the most important business strategies as they allow companies to gain a competitive edge. These approaches are basically made from different viewpoints of innovation, friendliness, market segmentation, partnership, aftermarket support, and the whole solutions.

Technology improvements play a pivotal role in establishing leadership in the niche. Companies are now in the business of continuously dedicating funds to research and development as they bring advanced diagnostic scan tools to the market that offer proficient diagnoses and complete vehicle coverage. Innovations will mostly lean towards wireless connectivity, cloud-based diagnostics and real-time data analysis as well as compatibility with the bulk of car models available on the market. In their demonstration of state-of-the-art technologies, companies boast their competence as the relevant and advanced level of quality solutions providers.

Of course, user-friendliness is the next thing being defined by this assignment. The latter streamlines all processes and provides companies with tools that have intuitive interfaces and easy-to-understand reports. This reduces time wastage and makes the tools manageable by technicians of different skill levels. This positions companies as providers of user-centric solutions that result in high productivity and efficiency in automotive repairs and maintenance.

Market segmentation influences the focus of these positioning strategies. Firms segment the market to reach different sectors, which include the professional automotive repair shops, private mechanics, the individuals having a do-it-yourself hobby and the automotive manufacturers themselves. Delivering tailored diagnostics to suit specific needs and expertise levels of these market segments showcases the companies accountable for building niche products that the broad market may not offer.

Partnerships and collaboration also play a part in how you position yourself in this market. Interfacing and working with auto makers, software developers or component suppliers, expand the product offering to comprehensive solutions. Integration with OEM systems, manufacturer’s specific data reading or partnerships with players within the industry can be the contributing factor to diagnostic tool providers’ credibility and market positioning.

Once market support and after sales services are in place, this will have an impact on how the strategies are created. Providing reliable technical support, making available regular software updates and running training courses for technicians who use their diagnostic tools places companies in the customers' radius as partners who are always ready to help. A robust support for the aftermarket market breeds customers' satisfaction and loyalty which provide a good company market image.

Leave a Comment