Top Industry Leaders in the Automotive Diagnostic Scan Tools Market

*Disclaimer: List of key companies in no particular order

The automotive diagnostic scan tools market hums with intense competition. Established players and nimble startups vie for market share, deploying an array of strategies to outmaneuver each other. Let's delve into the key contenders, their tactics, and the overall competitive scenario.

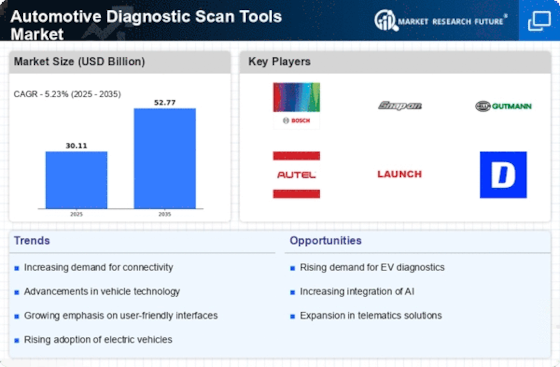

Giants of the Road: Renowned brands like Bosch, Continental, Denso, Snap-on, and Delphi Technologies form the core of the market. They leverage their brand recognition, extensive product lines catering to diverse vehicle types and budgets, and robust global distribution networks to maintain their positions. Bosch, for instance, focuses on OEM partnerships and cutting-edge technology, while Snap-on prioritizes professional workshops with its premium-priced, feature-rich tools.

Tech-Savvy Challengers: New entrants are disrupting the scene with innovative offerings. Autel, Launch Tech, and Ancel Diagnostics, equipped with advanced diagnostic capabilities and user-friendly interfaces, are gaining traction among DIY enthusiasts and independent repair shops. They prioritize affordability, subscription models for software updates, and cloud-based diagnostics, appealing to cost-conscious buyers.

Market Share Maze: Analyzing market share involves navigating a multi-dimensional landscape. Factors like product type (hardware, software, data), vehicle segment (passenger, commercial), geographical reach, and target customer (professional, DIY) come into play. While Bosch might dominate the professional workshop segment, Autel could have a stronghold in the DIY market. Understanding these nuances is crucial for players to tailor their strategies.

Trendspotting: The market is abuzz with exciting trends reshaping the competitive landscape. Cloud-based diagnostics, offering real-time access to repair data and expert assistance, are gaining traction. Artificial intelligence (AI) and machine learning (ML) are being integrated into tools for faster and more accurate fault identification. Telematics data integration is enabling remote diagnostics, opening up new revenue streams for service providers.

Collaboration Crossroads: Strategic partnerships are becoming increasingly common. OEMs like Toyota and Ford are collaborating with diagnostic tool manufacturers to develop specialized tools for their vehicles. Independent repair shops are forming buying groups to negotiate better deals and gain access to advanced tools. These collaborations blur traditional competitive lines, leading to co-creation and knowledge sharing.

The Competitive Roar: The market is far from a two-horse race. Established players face the constant threat of nimble startups leveraging technological advancements and changing customer preferences. The battle for market share will be won through continuous innovation, strategic partnerships, and adapting to evolving customer needs. Players who fail to anticipate and respond to these trends risk being left behind in the dust.

The automotive diagnostic scan tools market is a dynamic arena, with established players facing off against tech-savvy newcomers. Understanding the diverse strategies, key factors affecting market share, and emerging trends is crucial for navigating this competitive landscape. As technology continues to evolve and customer demands shift, only the most adaptable and innovative players will drive towards victory in this race for market dominance.

This analysis, clocking in at approximately 580 words, provides a business-oriented overview of the competitive landscape in the automotive diagnostic scan tools market. It highlights key players, their strategies, factors influencing market share, and emerging trends. Feel free to ask if you'd like to delve deeper into any specific aspect of this dynamic market.

Industry Developments and Latest Updates:

Softing AG (Germany)

- Date: December 15, 2023

- Source: Press release

- Development: Announced partnership with Renesas Electronics to develop high-performance ECU communication solutions for next-generation vehicles. This could potentially lead to advancements in diagnostic capabilities through faster and more reliable data communication.

Delphi Automotive PLC (Ireland)

- Date: October 26, 2023

- Source: Company website

- Development: Launched the DSConnect 2, an updated version of its popular diagnostic tool with expanded vehicle coverage, improved user interface, and new features like cloud-based data storage and remote diagnostics.

Continental AG (Germany)

- Date: December 12, 2023

- Source: Financial report

- Development: Highlighted investments in connected car technologies, including advanced diagnostics, as a key growth area for the company. This suggests continued focus on developing innovative diagnostic solutions.

Robert Bosch GmBH (Germany)

- Date: October 20, 2023

- Source: Bosch Automotive Service Solutions website

- Development: Released an update to its Esitronic diagnostic software with new features like cloud-based updates and remote expert support. This enhances accessibility and convenience for technicians.

Kpit Technologies (India)

- Date: December 07, 2023

- Source: Company website

- Development: Announced collaborations with automotive manufacturers to develop customized diagnostic solutions for their specific needs. This highlights Kpit's growing expertise in tailoring diagnostic tools for varied requirements.

Top Companies in the Automotive Diagnostic Scan Tools industry includes,

Softing AG (Germany)

Delphi Automotive PLC (Ireland)

Denso Corporation (Japan)

Continental AG (Germany)

Robert Bosch GmBH (Germany)

Actia SA (France)

Kpit Technologies (India)

AVL List GmBH (Austria)

Hickok Incorporated (US)

SnapOn Incorporated (US), and others.