Regulatory Standards and Compliance

The Automotive Carpet Market is influenced by stringent regulatory standards aimed at improving vehicle safety and environmental impact. Regulations concerning the use of hazardous materials and emissions are prompting manufacturers to adopt safer, more sustainable materials in their carpet production. Compliance with these regulations not only ensures market access but also enhances brand reputation among environmentally conscious consumers. Recent legislative changes have led to increased scrutiny of automotive materials, suggesting that the Automotive Carpet Market must adapt to these evolving standards. As a result, manufacturers are likely to invest in research and development to create compliant products that meet both safety and environmental criteria.

Growth in Electric Vehicle Production

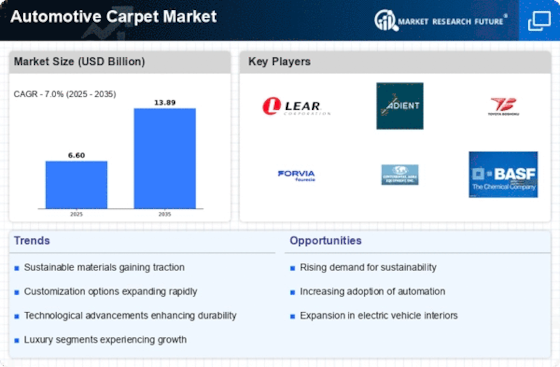

The Automotive Carpet Market is poised for growth due to the rising production of electric vehicles (EVs). As manufacturers pivot towards electric mobility, the demand for specialized automotive carpets that cater to the unique requirements of EVs is increasing. These carpets often incorporate sound-dampening materials and are designed to accommodate the absence of traditional engine noise. Recent statistics indicate that the EV market is expected to expand significantly, with projections suggesting that by 2030, electric vehicles could account for over 30% of total vehicle sales. This shift presents a substantial opportunity for the Automotive Carpet Market to innovate and develop products tailored to the evolving needs of the automotive landscape.

Increased Focus on Interior Aesthetics

The Automotive Carpet Market is witnessing a heightened emphasis on interior aesthetics as consumers increasingly prioritize comfort and luxury in their vehicles. This trend is particularly pronounced in the premium and luxury segments, where high-quality carpets play a crucial role in enhancing the overall interior experience. Manufacturers are responding by offering a diverse range of colors, textures, and designs, allowing for greater customization. Market data suggests that the luxury vehicle segment is projected to grow at a rate of 4% annually, further driving demand for premium automotive carpets. As a result, the Automotive Carpet Market is likely to see innovations that cater to aesthetic preferences while maintaining functionality and durability.

Rising Demand for Lightweight Materials

The Automotive Carpet Market is experiencing a notable shift towards lightweight materials, driven by the automotive sector's focus on enhancing fuel efficiency and reducing emissions. Manufacturers are increasingly adopting advanced materials such as nylon and polyester, which not only provide durability but also contribute to weight reduction. This trend is particularly relevant as vehicles become more fuel-efficient, with an emphasis on sustainability. According to recent data, the demand for lightweight automotive components is projected to grow at a compound annual growth rate of approximately 5% over the next five years. Consequently, the Automotive Carpet Market is likely to see a corresponding increase in the adoption of lightweight carpet solutions, aligning with broader industry goals of sustainability and efficiency.

Technological Advancements in Manufacturing

The Automotive Carpet Market is benefiting from technological advancements in manufacturing processes. Innovations such as automated weaving and advanced dyeing techniques are enabling manufacturers to produce carpets that are not only more durable but also environmentally friendly. These technologies allow for greater precision in design and the ability to create complex patterns that appeal to consumers. Furthermore, the integration of smart technologies into carpets, such as sensors for temperature regulation, is emerging as a potential trend. As the automotive industry continues to evolve, the demand for technologically advanced carpets is expected to rise, positioning the Automotive Carpet Market at the forefront of innovation.