Top Industry Leaders in the Automotive Carbon Fiber Composites Market

The automotive industry is undergoing a significant shift towards lightweight materials to improve fuel efficiency, performance, and safety. Among these materials, carbon fiber stands out for its exceptional strength-to-weight ratio, stiffness, and dimensional stability. This article dives into the competitive landscape of this dynamic market, exploring key players, strategies, market share factors, industry news, and recent developments

The automotive industry is undergoing a significant shift towards lightweight materials to improve fuel efficiency, performance, and safety. Among these materials, carbon fiber stands out for its exceptional strength-to-weight ratio, stiffness, and dimensional stability. This article dives into the competitive landscape of this dynamic market, exploring key players, strategies, market share factors, industry news, and recent developments

Strategies for Success:

-

Product Expansion: Leading players are expanding their product portfolios to cater to diverse vehicle applications. Toray Industries, for instance, launched its Tenax E fiber with superior drapability for complex shapes, while Mitsubishi Chemical Corporation introduced its lightweight and impact-resistant Pyrofil TC600 for underbody parts. -

Regional Expansion: Manufacturers are strategically expanding their regional presence to tap into growing markets. Teijin Limited established a new production facility in Thailand to serve Southeast Asia's booming automotive industry. -

Technological Advancements: Continuous research and development are crucial. Hexcel Corporation is investing in automated manufacturing processes to improve efficiency and reduce costs. SGL Carbon is focusing on developing bio-based precursors for sustainable carbon fiber production. -

Partnerships and Collaborations: Strategic partnerships are fostering innovation and market access. In January 2024, Solvay and Faurecia joined forces to develop lightweight multi-material solutions for electric vehicles. -

Investment in Recycling: With sustainability gaining traction, companies are investing in carbon fiber recycling technologies. BASF and Lanxess are collaborating on a project to chemically recycle carbon fiber composites.

Factors Influencing Market Share:

-

Production Capacity: Leading players with well-established production capacities, like Toray and Teijin, enjoy a competitive edge. New entrants like Hyosung are investing heavily to increase capacity. -

Cost Competitiveness: The high cost of carbon fiber remains a challenge. Continuous process improvements and economies of scale are crucial for market share dominance. -

Technology Leadership: Companies offering advanced fiber types and composite solutions with superior performance attract premium customers. -

Geographical Reach: A strong global presence with established relationships with automakers provides a significant advantage. -

Customer Relationships: Building strong partnerships with automakers through joint development projects and technical support is key to securing long-term contracts.

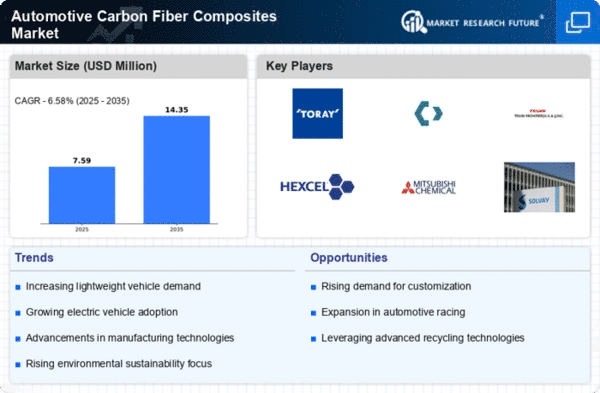

Key Players:

Teijin Limited (Japan),

Cytec Industries, Inc (U.S.),

SGL Carbon (Germany),

Toray Industries Inc. (Japan).

Recent Developments:

-

August 2023: Teijin and Applied EV announce a collaboration on a polycarbonate solar roof for electric vehicles, potentially reducing weight and increasing range. -

September 2023: SGL Carbon SE partners with BMW to develop and supply carbon fiber components for the iX electric SUV, highlighting the growing trend of OEM collaborations. -

October 2023: Hexcel and Hyundai Motor Group sign a Memorandum of Understanding to explore joint development of carbon fiber composite components for future Hyundai vehicles. -

December 2023: Toray introduces a new high-performance carbon fiber specifically designed for automotive applications, offering improved strength and crashworthiness.