Regulatory Support

Regulatory support is a crucial driver for the Europe Carbon Fibre Composite Market. The European Union has established various policies aimed at promoting the use of advanced materials, including carbon fibre composites, in key industries. Regulations that encourage the adoption of lightweight materials in automotive and aerospace applications are particularly influential. For example, the EU's Horizon 2020 program provides funding for research and innovation projects that focus on sustainable materials. This regulatory framework not only incentivizes manufacturers to invest in carbon fibre technologies but also ensures that they remain competitive in a global market increasingly focused on sustainability. As these regulations evolve, they are likely to create a more favorable environment for the growth of the carbon fibre composite market in Europe.

Collaborative Efforts

Collaborative efforts among industry stakeholders are significantly influencing the Europe Carbon Fibre Composite Market. Partnerships between manufacturers, research institutions, and government bodies are fostering innovation and accelerating the development of new applications. For instance, initiatives like the European Composites Industry Association (EUCIA) are promoting knowledge sharing and best practices among members. These collaborations are essential for addressing challenges such as high production costs and the need for improved recycling methods. By pooling resources and expertise, stakeholders can enhance the competitiveness of carbon fibre composites in Europe, potentially leading to a more robust market presence. The synergy created through these partnerships is expected to yield advancements that will further solidify the position of carbon fibre composites in various sectors.

Sustainability Initiatives

The Europe Carbon Fibre Composite Market is experiencing a notable shift towards sustainability initiatives. Governments across Europe are implementing stringent regulations aimed at reducing carbon emissions and promoting eco-friendly materials. For instance, the European Union's Green Deal emphasizes the importance of sustainable practices in manufacturing. This has led to increased investments in carbon fibre composites, which are lighter and more durable than traditional materials, thereby enhancing energy efficiency in various applications. The market is projected to grow as industries, particularly automotive and aerospace, seek to comply with these regulations while also appealing to environmentally conscious consumers. The integration of recycled carbon fibres into production processes further supports sustainability goals, potentially increasing the market share of carbon fibre composites in Europe.

Technological Advancements

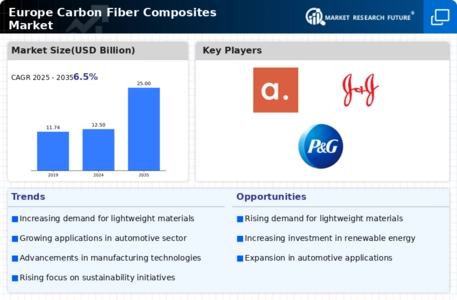

Technological advancements play a pivotal role in shaping the Europe Carbon Fibre Composite Market. Innovations in manufacturing processes, such as automated fibre placement and advanced resin systems, are enhancing the performance and reducing the costs of carbon fibre composites. The introduction of new materials and hybrid composites is also expanding the application range, particularly in the automotive and aerospace sectors. For example, the use of carbon fibre reinforced plastics (CFRP) in vehicle production has been shown to reduce weight by up to 50%, significantly improving fuel efficiency. As these technologies continue to evolve, they are likely to drive further adoption of carbon fibre composites across various industries in Europe, contributing to a projected market growth rate of approximately 10% annually over the next five years.

Growing Demand in Aerospace and Automotive Sectors

The growing demand in the aerospace and automotive sectors is a significant driver for the Europe Carbon Fibre Composite Market. As manufacturers strive to enhance performance and reduce weight, carbon fibre composites are becoming increasingly popular. In the aerospace sector, the need for fuel-efficient aircraft has led to a surge in the use of carbon fibre materials, which can reduce overall aircraft weight by up to 20%. Similarly, the automotive industry is witnessing a shift towards lightweight vehicles, with carbon fibre composites being utilized in high-performance models. This trend is expected to continue, with the European market projected to reach a valuation of over 5 billion euros by 2028. The increasing focus on performance, safety, and environmental impact is likely to further drive the adoption of carbon fibre composites in these sectors.