- Q2 2024: Knorr-Bremse appoints new CEO to drive innovation in brake systems Knorr-Bremse, a leading supplier of braking systems, announced the appointment of Marc Llistosella as CEO, effective July 1, 2024, to accelerate the company's focus on advanced automotive brake valve technologies and digitalization.

- Q2 2024: Continental opens new R&D center for advanced brake valve systems in Germany Continental AG inaugurated a new research and development facility in Frankfurt dedicated to the development of next-generation electronically controlled brake valves for electric and autonomous vehicles.

- Q3 2024: Bosch secures major contract to supply brake valves for leading EV manufacturer Bosch announced it has won a multi-year contract to supply advanced brake valve assemblies to a top global electric vehicle manufacturer, with deliveries starting in late 2024.

- Q2 2024: ZF launches new modular brake valve platform for commercial vehicles ZF introduced a modular brake valve platform designed to improve performance and integration in commercial vehicles, supporting both pneumatic and electronic braking systems.

- Q1 2025: Hitachi Astemo announces partnership with Tata Motors for advanced brake valve technology Hitachi Astemo and Tata Motors entered a strategic partnership to co-develop and localize advanced brake valve systems for the Indian automotive market, targeting both passenger and commercial vehicles.

- Q2 2025: WABCO opens new manufacturing facility for brake valves in Mexico WABCO inaugurated a new plant in Monterrey, Mexico, to expand production capacity for automotive brake valves, aiming to meet growing demand in North and South America.

- Q3 2024: Valeo acquires minority stake in brake valve startup Sensobrake Valeo announced the acquisition of a 20% stake in Sensobrake, a startup specializing in smart brake valve technology, to accelerate innovation in sensor-driven braking systems.

- Q4 2024: Brembo unveils new electronic brake valve for high-performance vehicles Brembo launched its latest electronic brake valve, designed for integration with advanced driver-assistance systems (ADAS) in sports and luxury vehicles.

- Q1 2025: Knorr-Bremse wins contract to supply brake valves for European commercial vehicle fleet Knorr-Bremse secured a contract to deliver its latest generation of brake valves to a major European logistics company, supporting the fleet's transition to safer and more efficient vehicles.

- Q2 2025: Magneti Marelli announces $100M investment in brake valve production line in Italy Magneti Marelli committed $100 million to expand its brake valve manufacturing capabilities at its Bologna facility, focusing on components for electric and hybrid vehicles.

- Q3 2025: Haldex launches next-gen air brake valve for heavy-duty trucks Haldex introduced a new air brake valve designed to enhance safety and efficiency in heavy-duty trucks, featuring improved durability and digital diagnostics.

- Q2 2024: Toyota receives regulatory approval for new brake valve system in Japan Toyota obtained approval from Japanese regulators for its newly developed brake valve system, enabling deployment in upcoming hybrid and electric vehicle models.

Chief Variables Existing in the Market

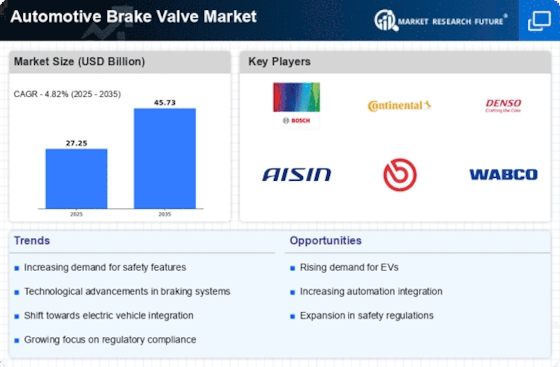

Some of the key drivers that increase the attractiveness of the global market, which include the increasing focus of automobile producers on designing efficient and safer braking systems that are aligned with tough road and vehicle safety norms and advancement in the existing braking system such as dynamic stability control and electronic stability control.

A major challenge that exists in the global market relates to high competition. It increases uncertainty for businesses that operate in it. The introduction of new rules and guidelines relating to road and vehicle safety also acts as a major challenge that impacts the ability of businesses to adapt to the market.

- Opportunities in the global market

As there is a surge in demand for passenger cars, the market players have the opportunity to upgrade the efficiency and functionality of the existing braking solutions. Companies also need to invest in research and development activities so that new and innovative products could be launched on the market that would focus on customers' safety. During the forecasted period, businesses need to devise suitable strategies to exploit diverse market opportunities and increase their profitability.

The chief restraints in the global automotive brake valve market include the lack of technical expertise by the workforce that operates in the dynamic industry and the restricted degree of scalability. During the forecasted period, these factors could limit the ability of businesses to exploit the market opportunities.

Cumulative Evaluation of the Market

The comprehensive analysis of the market has helped to ascertain its growth potential in the future. The market is highly promising as companies and customers have been emphasizing road and vehicle safety. The report has identified and thoroughly evaluated a diverse range of global trends of automotive brake valves. The integration of new technology is one of the major trends that can bring about transformational change in the global market landscape.

Overview of the main Market Segments

The global automotive brake valve market can be segmented into metering, pressure differential, proportionate, combination, hydraulic, and others based on the product type. The demand for the metering segment is high as it helps maintain appropriate balance by supporting fluid flow control from the master cylinder. During the forecasted period, the demand for the metering segment is expected to rise.

The global market can be segmented into steel, copper, brass, and others based on the material type. The material that is used in the braking solutions impacts their functionality and performance. During the forecasted period, each material segment is likely to capture a considerable portion of the global market share and impact its future performance.

The global automotive brake valve industry can be divided into passenger cars, light commercial vehicles (LCV), and heavy commercial vehicles (HCV). In each of these categories of vehicles, the role of the automotive brake valve is to improve the vehicle's safety. The demand for the passenger car segment is expected to contribute to the automotive brake valve market growth during the forecasted period.

The automotive brake valve market can be segmented into original equipment manufacturer (OEM) and aftermarket based on sales channels. The demand for the OEM market segment is expected to dominate the global market size during the forecasted period. The high focus on innovative braking solutions by manufacturers operating in the OEM segment is expected to act as a catalyst to boost market performance.

Automotive Brake Valve Market Regional Analysis

The global automotive brake valve industry can be segmented into numerous geographical segments such as North America, Europe, the Asia Pacific, and the rest of the world. The Asia Pacific region has been dominating the market due to a high share in fleet size. During the forecasted period, the region is expected to continue to showcase solid performance, and thus it would lead to the expansion of the global automotive brake valve market size.