Automotive Brake Fluid Market Summary

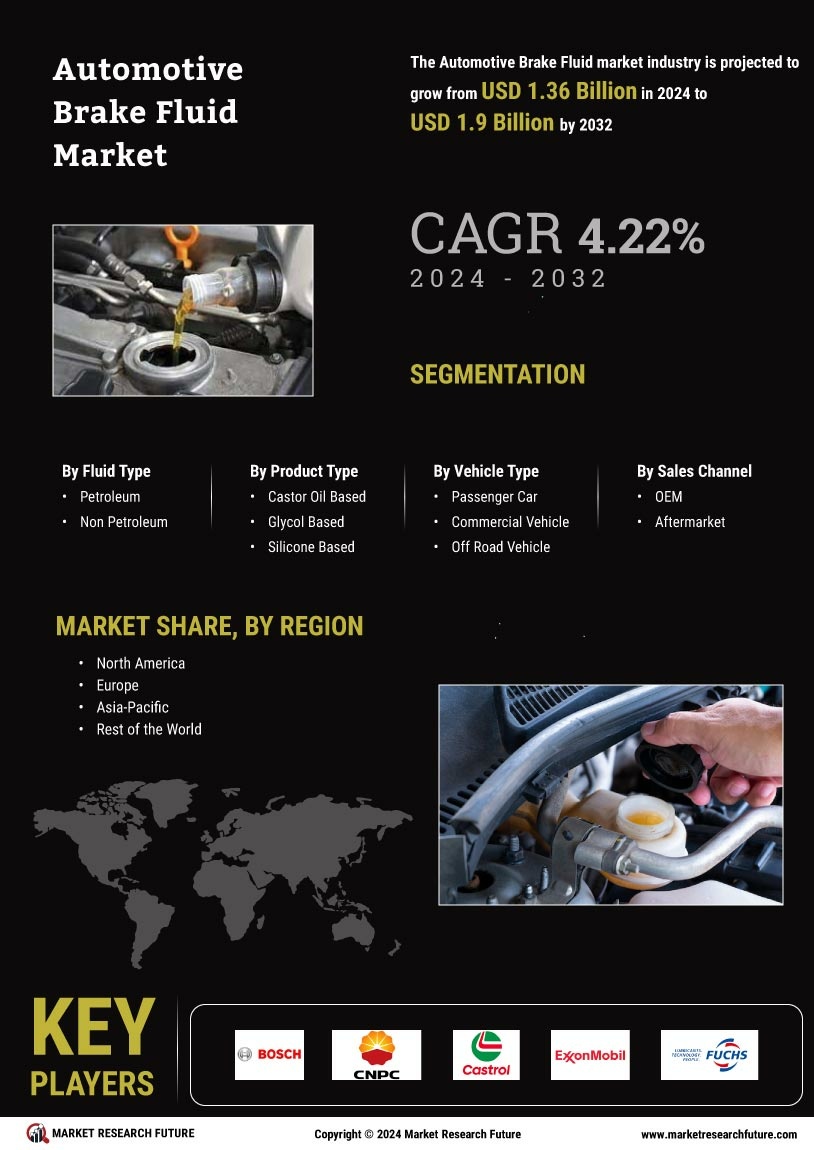

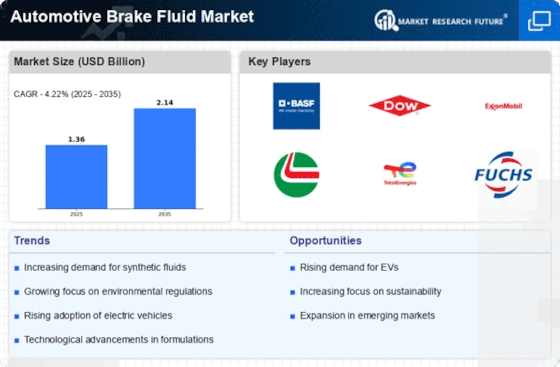

As per Market Research Future analysis, the Automotive Brake Fluid Market Size was estimated at 1.36 USD Billion in 2024. The Automotive Brake Fluid industry is projected to grow from 1.417 USD Billion in 2025 to 2.143 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.2% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Automotive Brake Fluid Market is experiencing a dynamic shift towards eco-friendly formulations and advanced technologies.

- The market is witnessing a notable shift towards eco-friendly formulations, driven by increasing environmental awareness.

- Technological advancements in fluid performance are enhancing the efficiency and safety of braking systems.

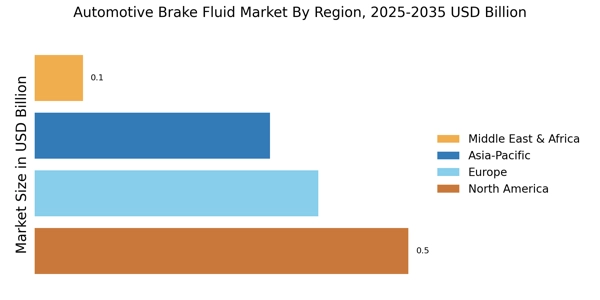

- North America remains the largest market, while Asia-Pacific is emerging as the fastest-growing region in automotive brake fluid consumption.

- Key market drivers include rising vehicle production and regulatory compliance, which are propelling demand for both petroleum and non-petroleum brake fluids.

Market Size & Forecast

| 2024 Market Size | 1.36 (USD Billion) |

| 2035 Market Size | 2.143 (USD Billion) |

| CAGR (2025 - 2035) | 4.22% |

Major Players

BASF (DE), Dow (US), ExxonMobil (US), Castrol (GB), TotalEnergies (FR), Fuchs Petrolub (DE), Valvoline (US), Motul (FR), Prestone (US)