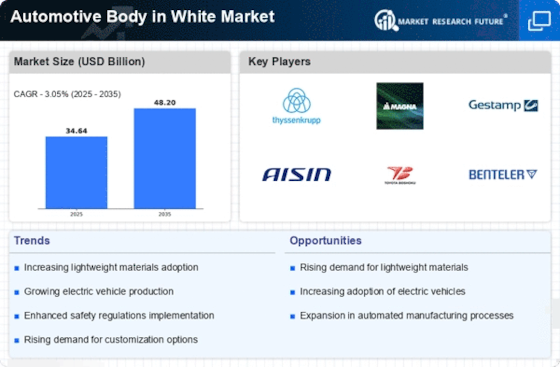

Increasing Demand for Electric Vehicles

The Automotive Body in White Market is experiencing a notable shift due to the rising demand for electric vehicles (EVs). As manufacturers pivot towards EV production, the need for lightweight and efficient body structures becomes paramount. This transition is driven by consumer preferences for sustainable transportation options, which has led to a projected increase in EV sales. In 2025, it is estimated that EVs will account for a significant portion of new vehicle sales, thereby influencing the design and materials used in the Automotive Body in White Market. The integration of advanced materials such as aluminum and composites is likely to enhance vehicle performance and range, further propelling market growth.

Rising Consumer Preferences for Customization

Consumer preferences are evolving towards greater customization in vehicle design, which is impacting the Automotive Body in White Market. As buyers seek personalized features and aesthetics, manufacturers are compelled to adapt their production strategies. This trend is expected to drive the demand for flexible manufacturing systems that can accommodate varied body designs without compromising efficiency. In 2025, it is likely that the ability to offer customized body structures will become a competitive advantage for manufacturers. This shift not only enhances consumer satisfaction but also encourages innovation within the Automotive Body in White Market, as companies explore new materials and designs to meet diverse consumer needs.

Regulatory Pressure for Enhanced Safety Standards

The Automotive Body in White Market is significantly influenced by regulatory pressures aimed at enhancing vehicle safety standards. Governments worldwide are implementing stricter regulations regarding crashworthiness and structural integrity, compelling manufacturers to invest in advanced body designs. In 2025, it is projected that compliance with these regulations will necessitate the use of high-strength materials and innovative design techniques. This focus on safety not only protects consumers but also drives competition among manufacturers to develop superior body structures. Consequently, the Automotive Body in White Market is likely to witness increased investments in research and development to meet these evolving safety requirements.

Sustainability Initiatives and Eco-Friendly Materials

Sustainability is becoming a central theme in the Automotive Body in White Market, as manufacturers increasingly prioritize eco-friendly materials and processes. The push for reduced carbon footprints is leading to the adoption of recyclable and biodegradable materials in vehicle production. In 2025, it is anticipated that a significant portion of body structures will incorporate sustainable materials, aligning with global environmental goals. This trend not only addresses consumer concerns regarding environmental impact but also positions manufacturers favorably in a competitive market. The integration of sustainable practices within the Automotive Body in White Market is likely to foster innovation and drive growth as companies seek to differentiate themselves through eco-conscious offerings.

Technological Advancements in Manufacturing Processes

Technological innovations are reshaping the Automotive Body in White Market, particularly through advancements in manufacturing processes. Automation and robotics are increasingly being adopted to enhance production efficiency and precision. These technologies not only reduce labor costs but also improve the quality of the body structures produced. In 2025, it is anticipated that the implementation of Industry 4.0 principles will streamline operations, allowing manufacturers to respond swiftly to market demands. The use of computer-aided design (CAD) and simulation tools is also expected to optimize the design phase, leading to more innovative and robust body structures in the Automotive Body in White Market.