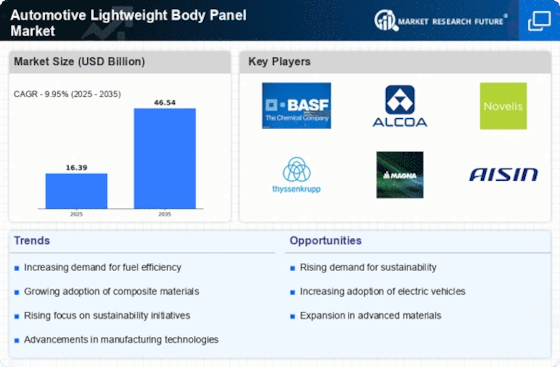

Consumer Demand for Fuel Efficiency

In the Automotive Lightweight Body Panel Market, consumer preferences are shifting towards vehicles that offer enhanced fuel efficiency. As fuel prices fluctuate, consumers are increasingly seeking cars that provide better mileage, prompting manufacturers to explore lightweight body panels as a viable solution. Research indicates that reducing vehicle weight by just 10% can lead to a fuel efficiency improvement of approximately 6-8%. This correlation between weight reduction and fuel economy is driving automakers to invest in lightweight materials, such as high-strength steel and carbon fiber composites. Consequently, the Automotive Lightweight Body Panel Market is experiencing a robust growth trajectory as manufacturers respond to this consumer demand for more efficient vehicles.

Regulatory Compliance and Standards

The Automotive Lightweight Body Panel Market is increasingly influenced by stringent regulations aimed at reducing vehicle emissions and enhancing fuel efficiency. Governments worldwide are implementing policies that mandate lower carbon footprints for vehicles, which in turn drives the demand for lightweight materials. For instance, regulations such as the Corporate Average Fuel Economy (CAFE) standards in the United States have prompted manufacturers to adopt lighter body panels to meet compliance. This shift not only aids in reducing overall vehicle weight but also contributes to improved performance and fuel economy. As a result, the Automotive Lightweight Body Panel Market is witnessing a surge in the adoption of advanced materials like aluminum and composites, which are essential for meeting these regulatory requirements.

Rise of Electric and Hybrid Vehicles

The Automotive Lightweight Body Panel Market is experiencing a notable impact from the rise of electric and hybrid vehicles. As these vehicles typically require lighter components to maximize battery efficiency and range, manufacturers are increasingly turning to lightweight body panels. The integration of lightweight materials is essential for offsetting the weight of batteries, which can be substantial. Reports suggest that electric vehicles can benefit from a weight reduction of up to 20% through the use of advanced lightweight materials. This trend is prompting automakers to innovate and adapt their designs, thereby driving growth in the Automotive Lightweight Body Panel Market as they seek to enhance the performance and efficiency of electric and hybrid models.

Competitive Pressure and Market Dynamics

The Automotive Lightweight Body Panel Market is characterized by intense competition among manufacturers striving to gain market share. This competitive pressure is compelling companies to innovate and adopt lightweight materials to differentiate their products. As automakers seek to enhance vehicle performance and reduce costs, the demand for lightweight body panels is escalating. Market dynamics indicate that companies investing in research and development of new materials and manufacturing techniques are likely to gain a competitive edge. Furthermore, collaborations between automotive manufacturers and material suppliers are becoming increasingly common, fostering innovation in the Automotive Lightweight Body Panel Market. This collaborative approach is expected to drive advancements in lightweight technologies, further propelling market growth.

Technological Innovations in Material Science

The Automotive Lightweight Body Panel Market is significantly benefiting from advancements in material science and engineering. Innovations such as the development of high-strength, low-weight materials are enabling manufacturers to produce body panels that not only meet safety standards but also enhance vehicle performance. For example, the introduction of advanced composites and aluminum alloys has revolutionized the design and manufacturing processes in the automotive sector. These materials offer superior strength-to-weight ratios, which are crucial for the production of lightweight body panels. As technology continues to evolve, the Automotive Lightweight Body Panel Market is likely to see further enhancements in material properties, leading to even lighter and more durable body panels.